Jusan Bank Shareholder's 32 Billion Tenge Could Be Stuck in Russian Securities

Orda

Orda

Kazakhstan has to walk a tightrope due to the sanction confrontation between Russia and the countries of the "collective West". The financial analytics department of Orda.kz has looked into the fate of billions of investments from Kazakhstan stuck in the Russian securities market. The brokerage company First Heartland Securities (FHS) - the main shareholder of Jusan Bank, is among them.

Inaccessible Investments

We have already written about the investments that Kazakhstani companies once invested in securities, namely dollar bonds issued by companies from Russia.

Everything related to the mechanisms of interaction of international financial markets is incredibly complicated, but we will try to briefly and simply explain how Kazakhstani investors' money got stuck in Russia.

The problem arose back in March 2022 and has yet to be resolved. Western countries have imposed sanctions against Russia, effectively blocking its and Russian companies' access to the global securities market. Russian companies' shares and bonds traded in foreign currency on foreign exchanges were supposed to return to exchanges in Moscow or St. Petersburg. The Kremlin has returned the favour by allowing its companies to make payments on Russian securities only in rubles. There is still no mechanism for foreign investors to get these rubles.

Investors from Kazakhstan cannot withdraw their money along with investors from the so-called "unfriendly countries". The money is actually frozen until Russia develops and implements the appropriate mechanisms. As time goes by, the ruble gradually depreciates, thus affecting such payments.

Kazakhstan's Trace

Among the Kazakhstani companies that once bought foreign currency bonds from Russian companies was First Heartland Securities (FHS), Jusan Bank's main shareholder.

Sanctions have notably caused global rating agencies such as S&P Global, Moody's and Fitch to withdraw their credit ratings of Russia and all Russian companies.

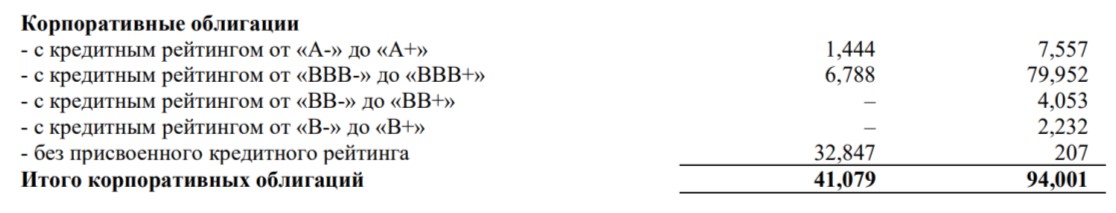

From the consolidated report on the results of FHS activities in 2022, we learned that as of December 31, 2022, the company's balance sheet contains corporate bonds without a credit rating for 32.84 billion tenge (first column).

The report notes that, in addition to Russian Eurobonds, unrated securities also include bonds of the Eurasian Development Bank (EDB) and the Central Asian Electric Power Corporation (CAEPCO). In 2021, there were only 207 million tenge of unrated bonds (second column). We believe that they are EDB's and CAEPCO's bonds.

Compared to last year, bonds with a rating from “BBB-” to “BBB+” have significantly decreased. Russian bonds perhaps fell into this category earlier. S&P did not withdraw EDB's ratings, as Russia does not have a controlling stake in it. Changes are, therefore, unlikely as well.

At the end of 2021, FHS's portfolio had bonds for 94 billion tenge. 32 billion tenge, or more than a third. They may be in Russian securities. In this scenario, there is too much concentration of risk in one country, which at that moment was also preparing for war. A rather strange investment strategy designed to earn money for Nazarbayev University and Nazarbayev Intellectual Schools.

Regulator?

Orda's editors sent a request to the Agency of the Republic of Kazakhstan for Regulation and Development of the Financial Market (ARDFM) in an attempt to clarify the situation and find out the issue's true scale among domestic investors.

However, the regulator's press service was only able to confirm the number of Russian companies' bad debts to Kazakhstani investors previously announced by the Central Securities Depository (CSD), which is $57 million (25.6 billion tenge). FHS alone has even more Russian securities on its balance sheet.

Not all dollar bonds purchased by Kazakhstani investors from Russian companies are taken into account on the CSD accounts. Many securities are kept in custodian banks - Kazakhstani and foreign. At the same time, ARDFM probably has a more or less complete picture of the problem, as the supervision perimeter includes Kazakhstani banks, insurance and brokerage companies that bought Russian securities, both for themselves and for their clients. The only area beyond the reach of the ARDFM is securities purchased through foreign brokers and investment bankers.

Billion-Dollar Question

FHS is not the only company that bought Russian dollar bonds and now cannot return the invested funds. Many banks and brokers bought Russian bonds for investment purposes. There are probably companies from the quasi-public sector among them.

Halyk Bank in its consolidated financial statements for 2022 indicates that the gross risk in relation to Russian securities and banks is 35.8 billion tenge, while the net risk is 15.5 billion tenge. In the annual consolidated statements of Bank CenterCredit for 2022, 12.47 billion tenge invested in Russian securities are at stage 2 of credit risk. Given the volume of their income and assets, the possible losses from these investments are relatively painless for them.

Kazakhstani experts' most optimistic estimates suggest the amount is at least half a billion US dollars that is inaccessible to Kazakhstani companies. We looked at the reports of only three Kazakhstani companies and found about 80 billion tenge stuck in Russia. There may be much more investors from among domestic companies - twenty or thirty. The professional community's assessments may thereby seem somewhat underestimated.

Private companies losing money is an entrepreneurial risk materializing, but what if the money of state-owned companies is stuck in Russia? Then does this mean that this is a material loss for all citizens of Kazakhstan?

Original Author: Orda

DISCLAIMER: This is a translated piece. The text has been modified, the content is the same. Please refer to the original article in Russian for accuracy.

Latest news

- President Toqayev Sends Nazarbayev Birthday Wishes

- Toqayev Appoints New Ambassadors in Series of Diplomatic Changes

- Unidentified Object Resembling Drone Found in Atyrau Region

- Trump and Zelenskyy Discuss Air Defense Needs

- Rapper Qurt: Wife Withdraws Statement in Court

- Head of Azerbaijani Cultural Autonomy in Moscow Region Reportedly Loses Russian Citizenship

- Defense Secretary Hegseth Paused Ukraine Weapons Shipment Despite Pentagon Assessment — NBC

- Prosecutor General's Office Confirms Detention of Kozhamzharov's Associate in Torture Case

- State to Scale Back Role in Competitive Sectors

- Uzbek Banker Kidnapped in Paris

- Former Financial Police Officials Reportedly Detained, Case Concerns Torture

- Progress MS-31 Launches from Baikonur Carrying Fuel, Water, and Scientific Cargo

- Two Men to Face Trial for Homicide of Missing Atyrau Woman, Body Not Found

- Russia Launched Massive Strike on Ukraine Following Trump–Putin Call

- Rapper Qurt Accused of Abuse by Wife

- Pavlodar Region: Rescuers Seek Lower Retirement Age Amid Strain of Risky Work

- Businessman Vagif Suleymanov Detained in Moscow

- Kashagan Field Reaches One Billion Barrels of Oil Extracted

- Lenin Street in Osh Renamed After 19th-Century Kyrgyz Leader

- New Uranium Plant Launched in Turkistan Region with French Partnership