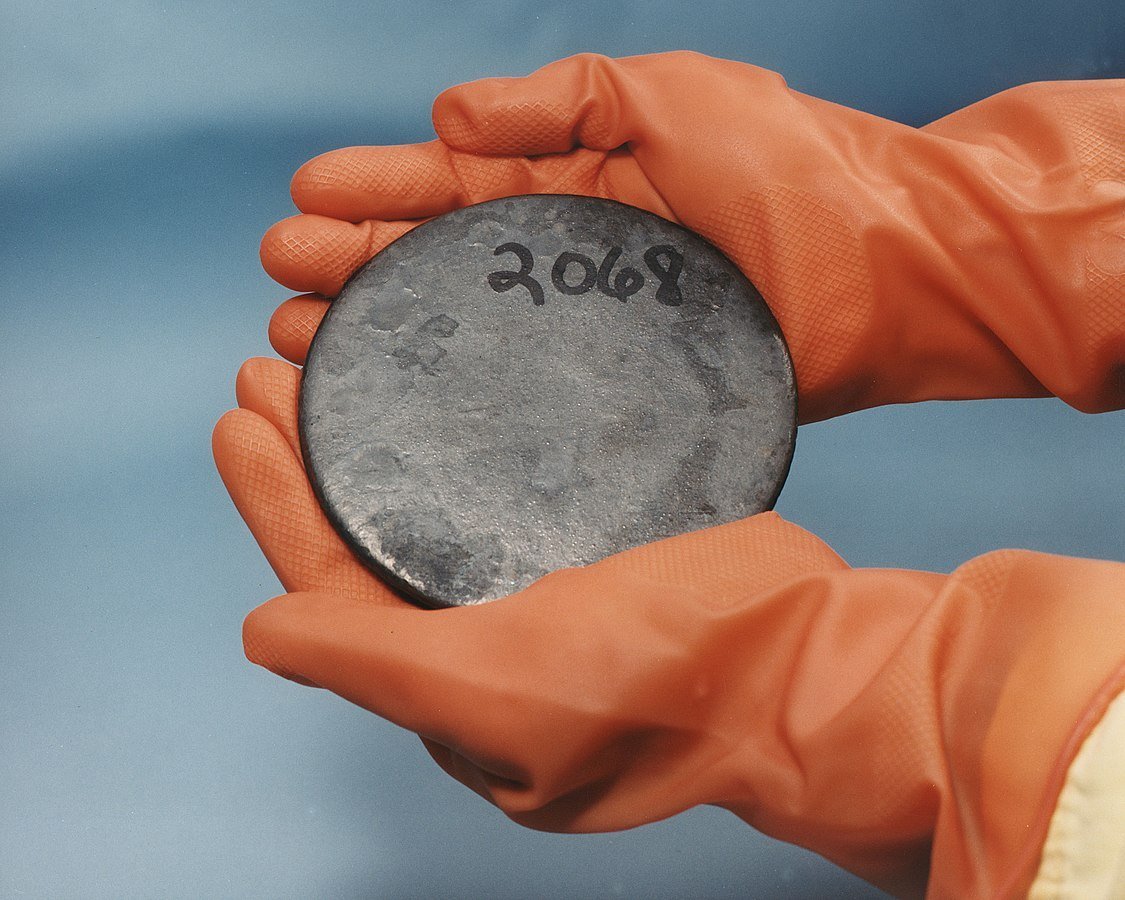

Uranium: Can Kazakhstan Capitalize?

Kazakhstan ranks first in the world in Uranium production and second in terms of reserves, thus explaining the recent shock on the uranium market brought about by a decision made by Kazakh authorities. Orda.kz has looked into the matter.

There Are Only Two Guarantees in Life.

Mining uranium in Kazakhstan will become more costly as early as 2025. The government has amended the Tax Code: if uranium's mineral extraction tax (MET) is currently fixed at six percent, then from January 1 next year, the rate will jump to nine percent.

Starting in 2026, the tax will no longer be fixed. The amount of the MET will depend on the annual production volume under each contract. Companies producing less uranium will pay less taxes, whereas production above 4,000 tons per year will be subject to 18%. The tax will increase threefold for key producers compared to the current one.

Political scientist and economist Anuar Bakhitkhanov believes that increasing the tax rate on uranium mining is logical, as this would generate new budget contributions.

Replenishing the budget by increasing taxes in the uranium mining sector is a bold and necessary step. Kazakhstan is a leader in uranium mining and has one of the richest reserves in the world. The country's leadership can and does make changes in the market, taking into account today's economic realities. Anuar Bakhitkhanov

The sharp increase in tax rates will extend to Kazatomprom and its companies. Mining large quantities of uranium will become much less profitable, decreasing production in the country.

As soon as the Kazakh authorities' decision surfaced, the global uranium market reacted. Uranium prices skyrocketed, reaching $86 per pound ($190 per kilogram) overnight. Demand is currently very high because several countries, primarily China and the United States, plan to launch new nuclear power plants. And since a reduction in production in Kazakhstan could lead to a uranium deficit, its value is climbing.

Uranium prices have shown a sharp rise for the third time this year. In January, a pound was worth more than $97 (about $219 per kilogram) amid a sharp increase in demand and a decline in global production. In March, the market began to react again due to a reduction in uranium supplies from Russia. Its cost is falling. Analysts at Russia's Finam predicted in April that uranium would cost more than $100 per pound in 2024.

Can Kazakhstan Capitalize?

Economist Anuar Bakhitkhanov notes that changing tax rates can have both positive and negative outcomes. If the positive aspects are apparent, then the negative ones are even more noteworthy.

On the one hand, the innovation will allow Kazakhstan to increase budget revenues and direct them to the development of the country. On the other hand, there is a risk of a reduction in uranium production and a deterioration in the investment climate, which could negatively affect the long-term sustainability of the industry. However, in my opinion, this is not so critical because the market is quite capacious and stable, says Anuar Bakhitkhanov.

Australian investment expert John Forwood noted in his article for Stockhead that Kazakhstan's state policy in mineral extraction is "unpredictable." In his opinion, increasing taxes will reduce Kazatomprom's production, which the analyst calls inefficient. Western countries, such as Canada, can benefit from this. Ahead of Kazakhstan in proven uranium reserves, Australia will not remain on the sidelines either.

It’s a disincentive. You’ve got Kazatomprom, where everyone is questioning whether they’ll actually be able to meet their production targets – they’re having construction issues, and they’re also having issues in sourcing sulphuric acid. It seems highly unlikely that they’ll be able to produce the maximum that they’re allowed to. <...> What is the OPEC of uranium, Kazakhstan has got two significant headwinds in terms of increasing production. And so that just plays more into the hands of the Western producers and developers, John Forwood said.

The expert believes that Kazakhstan is shooting itself in the foot by raising the tax. Foreign competitors will not shy away from the chance to increase their market share. Niger, another major uranium producer, is also factoring in. Its production will likely decrease in the coming months due to political turbulence.

Meanwhile, energy industry expert and director of the public fund Energy Monitor Nurlan Zhumagulov believes that the new tax rates will not have a noticeable impact on the volume of uranium mining in Kazakhstan. Uranium mining is a highly profitable, and it will only be fair if the companies pay more.

This will not affect the level of uranium production in Kazakhstan in any way. Today, the margins of uranium companies are already very high, over 40%, and for some, even 50%. When the excess profit tax was abolished in 2017, uranium miners began to have a wild margin, especially since uranium prices have risen, Nurlan Zhumagulov points out .

Prospects

A notable factor capable of affecting uranium production is Kazatomprom's technological capabilities. The company has significant issues with sulfuric acid, the main reagent used in uranium mining. Sulfuric acid allows for the most efficient uranium extraction. If there is a shortage of it, the overall uranium production will decrease.

Kazatomprom is aware of this issue and announced plans to build a new sulfuric acid plant in the Turkestan region, near the operating mines, back in 2023. The national company will receive 49% of the shares in this enterprise, and another 26% will go to Kazatomprom-SaUran LLP. Creating a new plant is no simple task. It should be launched in 2026, yet these dates may shift.

The new enterprise will ensure the production of sulfuric acid with a capacity of 800 thousand tons per year. The figures look impressive. Kazakhstan's need for at least three million tons of sulfuric acid annually to increase Kazatomprom's target indicators for uranium production should not be overlooked. The necessary volume of reagents is purchased in Russia, Uzbekistan, and other countries. This is up to 30-40% of the cost of production. Increasing uranium production is, therefore, problematic, regardless of tax rates.

Currently, uranium production is limited by a shortage of sulfuric acid. The construction of an additional sulfuric acid plant is being delayed, and because of this, uranium production is limited. The fact that taxes will increase from 2025-2026 is not so significant. And the demand for uranium is growing because more and more nuclear power plants are being built, explains Nurlan Zhumagulov.

In early 2024, Kazatomprom had to adjust production plans precisely because of the sulfuric acid shortage. The company also reported that it had difficulties with the global supply chain and limited access to key materials and reagents.

Kazatomprom has the potential to expand production. In June, the national company announced that it would begin developing one of the country's largest uranium deposits in the Turkestan region. A month later, reports surfaced that another site with significant deposits had been found in the same region. Exploring uranium does not mean mining it. And problems with reagents could significantly hamper this process, giving way to foreign producers eager to enter the profitable market.

Changes in the global uranium market are inevitable, and the most important thing is for the Kazakh authorities to utilize them to benefit Kazakhstan.

It is important how the government of Kazakhstan will manage these changes and what additional measures will be taken to mitigate possible negative consequences. Transparency and predictability of tax policy, as well as support for local producers, will be key factors in the successful implementation of these reforms,

summarizes economist Anuar Bakhitkhanov.

Original Author: Nikita Drobny

DISCLAIMER: This is a translated piece. The text has been modified, the content is the same. Please refer to the original piece published on 30/07/24 in Russian for accuracy.

Latest news

- EU Approves New Sanctions Targeting Russian Oil Industry and Banks

- Analyst Arman Beisembayev Explains the Record-Breaking Exchange Rate

- Qarmet and China’s Dadi Engineering Sign Coal Modernization Deal

- Zelenskyy Tasks Umerov with Intensifying Negotiations

- Georgian Dream Sees EU Visa Threat as Pressure

- Saken Mamash: Former Kazakh Diplomat Sentenced to Six Years for Abuse of Ex-Wife

- Kazakhstan Has Used 60% of Its National Fund Transfer Quota in First Half of 2025

- Oil Company Pays Nearly 200 Million Tenge in Wage Arrears

- Journalist Lukpan Akhmedyarov Says His YouTube Channel Has Been Removed

- Trump Raises the Stakes: Could Kazakhstan Face Secondary Sanctions?

- Uzbekistan, Afghanistan, and Pakistan Sign Agreement on Trans-Afghan Railway Feasibility Study

- Maintenance Completed at Pavlodar Petrochemical Plant Ahead of Schedule

- Tied to a Saddle and Dragged Across the Steppe: Family Blames Husband for Woman’s Death in Jetisu

- Renowned Poet and Playwright Israil Saparbay Passes Away at 84

- Scandal Over UAS Escalates with Russian Link and Legal Concerns

- Kairat Perizat: Witnesses Describe Fundraising at NIS and Large Cash Transfers in June 17 Hearing

- Syrian President Pledges Security For All Amid Sweida Tensions and Israeli Strikes

- KNB Anti-Corruption Service Detains Regional Tax Official in Aqmola

- Aqtau Faces Power Outages Amid MAEK Equipment Issues

- President Signs Law on Governance, Infrastructure Development