KBTU Dispute: Dinara Kulibayeva and the State Reach a Deal Over Almaty’s Historic University Building

Photo: Orda.kz

Photo: Orda.kz

Orda.kz has learned that the parties have reached an agreement on who will own the Kazakh-British Technical University and under what terms.

Several years of court disputes initiated by the Prosecutor’s Office have finally come to an end. The compromise acceptable to both sides is that the historic university building will be transferred to state ownership, while the NNEF Foundation will continue its educational activities — at least until it completes the construction of new facilities to relocate its students.

Public, Private, State: How KBTU Changed Hands

It all began during the Soviet era, when construction of the building started in 1936 with a budget of 14 million rubles — an enormous sum at the time. The project was halted by the war and only completed in 1957, becoming the Government House (Supreme Council of the Kazakh SSR).

Here, in 1991, Kazakhstan declared its independence, and in 1993, the country’s first Constitution was adopted. The building is now a historical and cultural monument of national significance.

The site became a university in 2000, when President Nursultan Nazarbayev and then UK Prime Minister Tony Blair signed a memorandum establishing the Kazakh-British Technical University. The assets were jointly held by the Ministry of Education and Science of the Republic of Kazakhstan and the British Embassy in Kazakhstan, represented by the British Council.

In 2003, by government decree, JSC NC KazMunayGas became KBTU’s sole shareholder. Under the 2018 privatization program, the Nursultan Nazarbayev Education Fund (NNEF) acquired 100 percent of KBTU’s shares for 11.37 billion tenge.

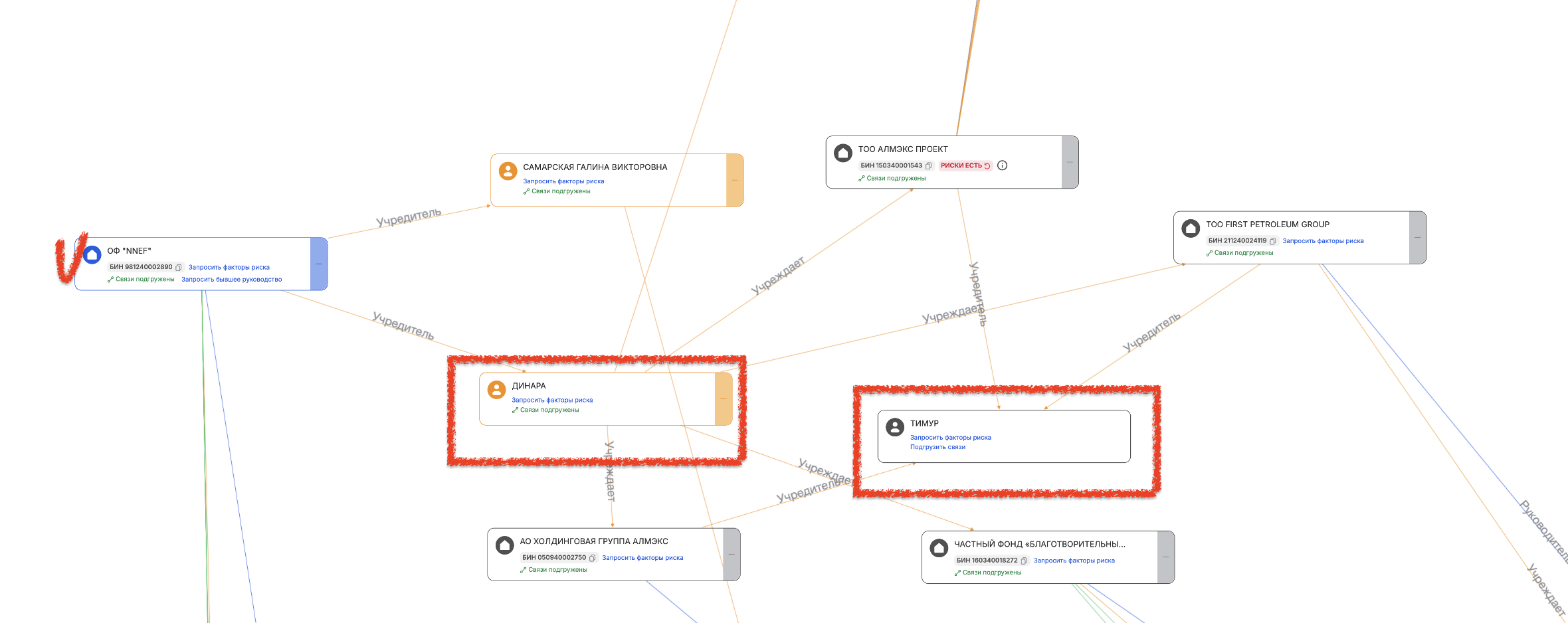

NNEF’s founders are Dinara Kulibayeva (daughter of Nursultan Nazarbayev) and Galina Samarskaya. The fund is directed by Svetlana Murzabekova. NNEF also participates in several projects, including Astana IT University, the Center for Innovation and Information Technologies, and the SOS Children’s Villages Kazakhstan.

Dinara Kulibayeva is the founder of Almex Holding Group JSC and Almex Project LLC. A co-founder of these companies is her husband, Timur Kulibayev, one of Kazakhstan’s most prominent businessmen.

When NNEF acquired ownership of KBTU, foundation representatives said the purchase required a major investment — several billion tenge. But the university’s fortunes soon improved: the number of students and educational programs increased, and, most importantly, its graduates became highly competitive in the job market.

In 2023, the Almaty Prosecutor’s Office launched a review of the tender through which the foundation had acquired the asset. The review cited several concerns that fueled public discontent. (Residents of Almaty had repeatedly called for the university to be returned to public ownership — likely without realizing the financial burden that such a move would entail.)

Prosecutors questioned the fairness of KBTU’s privatization, arguing that the university had been sold at too low a price. According to an audit, KBTU’s assets were worth 14.5 billion tenge before the deal, and the entire group of related companies was valued at 17.1 billion.

However, the university was sold for 11.37 billion tenge. Law enforcement officials claimed the price had been artificially lowered and that the appraisal by Baker Tilly Kazakhstan Advisory was improperly conducted, failing to account for key assets.

In particular, $25 million in sponsorship from Tengizchevroil, allocated for the creation of the Kazakhstan Maritime Academy, should have been included in the valuation. Prosecutors also argued that the assets of the university’s subsidiary, IEIT KBTU, were significantly understated.

The Nursultan Nazarbayev Educational Foundation categorically rejected these claims, accusing the prosecutor’s office of “juggling figures” and interpreting them arbitrarily. According to the foundation, the university had not been sold below market value but, in fact, above it.

Baker Tilly valued 100% of KBTU shares at 11.36 billion tenge, while the foundation paid 11.37 billion, or even more than 12 billion tenge after accounting for the installment plan (specifically, 12,110,187,000 tenge).

Both sides expressed dissatisfaction with the appraisers whose conclusions supported their opponents.

The prosecutor’s office also raised a second issue—the legitimacy of the tender process itself. Investigators believed that the tender NNEF won was largely a formality. Of the three participating companies, two — Yug Management Company and AGDS Group — were allegedly shell firms linked to the same businesswoman, Gulzana Serikova.

According to prosecutors, these companies were used to carry out sham transactions: contracts were signed for the supply of equipment, the money was transferred and then returned, but no deliveries ever occurred.

The foundation countered by citing the financial figures and turnover of all the companies involved. NNEF also argued that the prosecutor’s office had no legal authority to initiate proceedings at all, since the statute of limitations had already expired.

Despite its firm position, NNEF announced it was willing to transfer KBTU’s main building—the historic former Government House at 59 Tole Bi Street — to the state free of charge, on the condition that the university could continue to operate there temporarily to maintain its license and academic activities. The foundation even offered to transfer 5% of its shares to the state to comply with regulatory requirements.

That same year, no agreement was reached. On February 27, 2025, the Kazakh-British Technical University (KBTU), along with two of its constituent institutes—the D.V. Sokolsky Institute of Fuel, Catalysis, and Electrochemistry JSC and the A.B. Bekturov Institute of Chemical Sciences JSC — came under the control of the Returned Asset Management Committee. On March 4, the assets were formally transferred to state ownership.

Dinara Kulibayeva immediately declared that the decision would be challenged — and she meant it. In the end, the parties reached a solution that appeared to suit everyone. It is quite possible that the restructuring of the prosecutor’s office’s target function played a role in facilitating the outcome.

During the litigation, the agency responsible for recovering assets was reorganized and renamed the Committee for the Protection of Investor Rights — a shift that reflects a very different approach.

Original Author: Alexandra Mokhireva

Latest news

- The War in Iran Opens a Window of Opportunity for Kazakhstan’s Oil Sector, Analysts Say

- Iran Conflict Escalates Beyond the Gulf: What Kazakh Experts Say About Risks for Central Asia and Kazakhstan

- Kazakhstan Prepares Possible Evacuation of Its Citizens From Iran

- LRT in Astana Is Reaching the Finish Line: The Launch Is Expected in the Coming Months

- Kazakhstan Ready to Help the UAE Amid Escalation in the Region

- Tokayev Discusses Middle East Escalation With Qatar’s Emir

- Airlines Ready to Bring Kazakhstanis Home From the Middle East

- Tokayev Sends Support Messages to Gulf Leaders Amid Regional Escalation

- Kazakhstan Bans Its Airlines From Flying Over Several Middle East Countries

- Astana Strengthens Security Measures Amid Escalation Around Iran

- Tokayev Meets U.S. Ambassador Stufft, Discusses Board of Peace Cooperation

- Mangystau Launches AI-Assisted School Monitoring to Prevent Teen Suicidal Behavior

- Kazakhstan to Supply UK With Critical Minerals

- AI Faculties for Educators to Open in Kazakhstan: What Other Changes Are Coming to the Education Sector

- There Are Medals — But Not Enough Ice: What’s Happening to Figure Skating in Kazakhstan

- Is Kazakhstan’s Nuclear Power Plant Project at Risk After New UK Sanctions? Rosatom Responds

- Prosecutor General’s Office Suspends Extradition of Navalny Ex-Staffer Detained in Almaty

- Former EBRD Executive Jürgen Rigterink Elected as New Independent Director on Bank RBK’s Board of Directors

- Kazakhstan Near Bottom of Retirement Comfort Ranking

- Kazakhstan to Open New International Flights Across Asia, the Middle East and Europe