How Kazakhstan Can Turn into Meat “Powerhouse”- Expert Opinion

source: istockphoto.com

source: istockphoto.com

Kazakhstan has potential in the development of meat farming and becoming an international meat "powerhouse", but this is hampered by the lack of a competitive market and restrictions imposed by the government in order to saturate the domestic market.

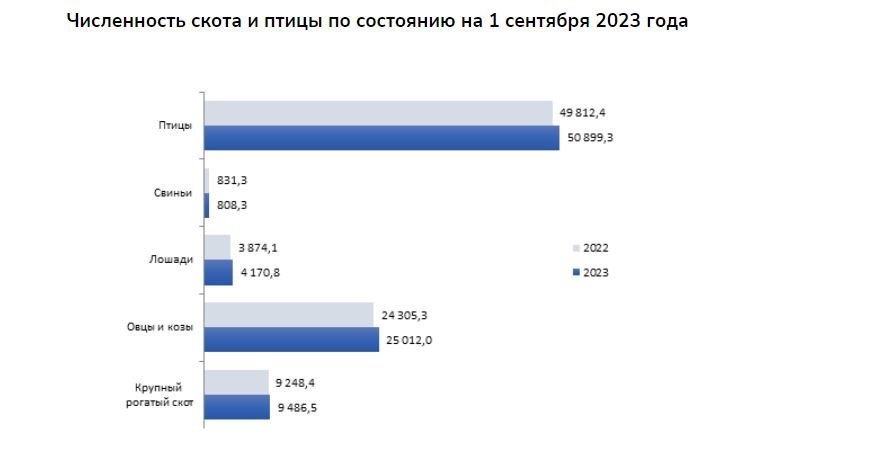

The Ministry of Agriculture reported that the number of agricultural animals is growing in Kazakhstan. The number of livestock on August 1 increased by 2.7% and amounted to 9.68 million heads. There are more horses (7.7% increase), the number of livestock is 4.2 million. The number of sheep increased by 3.6% to 23 million heads. At the same time, poultry slightly decreased by 0.3% to 49.6 million heads, the number of goats decreased by 3.9% to 2.6 million heads, pigs - 2.7% to 818.3 thousand heads.

Source: stat.gov.kz

Source: stat.gov.kzIn six months, the volume of meat production of all types in dressed weight in all farm categories amounted to 666.7 thousand tons. This is 4.6% more compared to the same period last year. By the end of 2022, 924.4 thousand tons of meat were produced. The domestic market is fully provided with livestock products via domestic production with the exception of poultry meat. The share of imported chicken in the country's market is 33%.

Nevertheless, there are also significant problems in the industry. The executive director of the Meat Union of Kazakhstan Askar Zhubatyrov told Orda about them.

Askar Zhubatyrov. Photo from the personal archive

Askar Zhubatyrov. Photo from the personal archiveThe livestock population is indeed on the rise, this can be seen even with the naked eye when we drive through the countryside. From this we can conclude that the Agribusiness 2020 program launched in 2013 has borne fruit. Prior to 2013, there was no industrial meat production in Kazakhstan. The cattle were all outbred, kept mainly on personal subsidiary plots, and the quality of the meat was low, our interlocutor said.

At the same time, about 30% of domestic meat farms were shuttered due to the pandemic, the subsequent closure of the Russian and Chinese markets, restrictive state measures on the export of live cattle, the economic recession in Kazakhstan.

In Kazakhstan, there is a constant increase in the supply of meat on the market, while demand remains more or less stable. If the population of the country increases by 1-1.2% per year, then the number of livestock’s increase may be 4%.

According to Askar Zhubatyrov, in 2021, beef production in Kazakhstan amounted to about 540 thousand tons, whereas the demand is 500 thousand tons. That is, last year the surplus was about 40 thousand tons, i.e. approximately 200 thousand heads.

Meat prices have nonetheless grown by 7-10% per year (below the official annual inflation). The average farmer, however, does notice the price increase because of intermediaries' presence on the market, resellers, who control everything at local bazaars, and control prices for both suppliers and end consumers. They disrupt market pricing. This is also an evident obstacle to animal husbandry’s sustainable development in the country.

The "shadow" buyers go about it like this: a farmer comes to the market and puts his animals up for sale. No one prevents him from selling. But all day long the same people come to him, who are in collusion and offer to sell their cattle for the same extremely low price. And already in the evening a new person comes, but from the same team, offers a slightly higher price, but at the cost price level, and the farmer usually agrees. Since there are no other options. It is very difficult to trade live cattle for several days, which need to be fed, watered, cleaned up after, waiting for a normal customer, plus you have to live somewhere yourself, said the director of the Meat Union.

This factor forces some producers to close, as it becomes unprofitable for them to breed beef cattle. Prices for feed and wheat are only increasing. The situation is complicated by climatic disasters, in particular prolonged and severe droughts. But farmers cannot compensate for these costs through price increases.

Source: stat.gov.kz

Source: stat.gov.kzThe second issue is that earlier in Kazakhstan there was an acute problem with monopolists, latifundists, and large farms owning huge territories, reservoirs, etc. Ordinary villagers and new entrepreneurs had nowhere to raise, graze and water cattle. Similar problems remain in certain grain-bearing areas.

These lands are also not always distributed competently or fairly. But this is the phenomena of local corruption, not land shortage.

The third issue is the problem of weak watering of pastures. This is a shared issue in Kazakhstan. At one time, the country had a program for drilling wells in all pastures. Subsidies were allocated for this. However, due to corruption and numerous violations in the spending of allocated funds, the government adjusted the program and cut funding drastically. This made life very difficult for conscientious farmers. Our interlocutor believes that it is necessary to continue the practice of watering pastures.

Now the issue is being considered that one of the conditions for obtaining state subsidies is the availability of tanks and technologies for collecting meltwater and rainwater. I have seen many such examples in Australia. In Kazakhstan, it is necessary to promote this topic as actively as possible, Askar Zhubatyrov noted.

The fourth issue is overgrazing, pasture trampling, and land degradation. This mainly concerns private households, whose owners graze animals near their settlements and constantly walk along the same routes.

The fifth issue is weak veterinary medicine. Outbreaks of pangolin, brucellosis and even anthrax occur, thereby making Kazakhstan’s products extremely unattractive in foreign markets.

The final issue is the lack of a fair pricing. To solve this and a number of other problems in animal husbandry, it is necessary to create and protect a free, competitive market where producers will be able to decide how many cattle to raise, to whom and at what price to sell.

In this case, manufacturers will not face problems with sales. Potential markets for Kazakh beef are the Russian Federation and China, where the total deficit is about 3 million tons per year.

Four Kazakh meat processing plants currently have the right to export frozen beef to China. Yet our entrepreneurs do not have a competitive edge, as Brazilian frozen beef dominates the market. Given that it is warm in Brazil all year round, cattle are constantly on pastures. This, in turn, generates a low production cost. Brazil is also able to supply its products via the cheaper traveling route: the sea.

Kazakhstan, meanwhile, needs to conduct 6-7 months of stable maintenance. But the country has great potential in the supply of chilled (steamed) meat that can be sold to China, where the wholesale purchase price of a kilogram of such beef nearly reaches $11. The average retail sale in Kazakhstan is 6 dollars.

Therefore, for the further development of the beef cattle industry, the Ministry of Agriculture of the Republic of Kazakhstan needs to make great efforts and focus on the issue of setting up chilled meat. In this scenario, the industry will develop in a competitive environment without subsidies and make the industry more attractive, Our interlocutor believes.

Fair pricing is key for the industry’s development. New entrepreneurs and investors will thereby display interest, the director of the Meat Union of Kazakhstan assures.

Original Author: Danil Utyupin

DISCLAIMER: This is a translated piece. The text has been modified, the context is the same. Please refer to the original piece in Russian for accuracy.

Latest news

- EU Approves New Sanctions Targeting Russian Oil Industry and Banks

- Analyst Arman Beisembayev Explains the Record-Breaking Exchange Rate

- Qarmet and China’s Dadi Engineering Sign Coal Modernization Deal

- Zelenskyy Tasks Umerov with Intensifying Negotiations

- Georgian Dream Sees EU Visa Threat as Pressure

- Saken Mamash: Former Kazakh Diplomat Sentenced to Six Years for Abuse of Ex-Wife

- Kazakhstan Has Used 60% of Its National Fund Transfer Quota in First Half of 2025

- Oil Company Pays Nearly 200 Million Tenge in Wage Arrears

- Journalist Lukpan Akhmedyarov Says His YouTube Channel Has Been Removed

- Trump Raises the Stakes: Could Kazakhstan Face Secondary Sanctions?

- Uzbekistan, Afghanistan, and Pakistan Sign Agreement on Trans-Afghan Railway Feasibility Study

- Maintenance Completed at Pavlodar Petrochemical Plant Ahead of Schedule

- Tied to a Saddle and Dragged Across the Steppe: Family Blames Husband for Woman’s Death in Jetisu

- Renowned Poet and Playwright Israil Saparbay Passes Away at 84

- Scandal Over UAS Escalates with Russian Link and Legal Concerns

- Kairat Perizat: Witnesses Describe Fundraising at NIS and Large Cash Transfers in June 17 Hearing

- Syrian President Pledges Security For All Amid Sweida Tensions and Israeli Strikes

- KNB Anti-Corruption Service Detains Regional Tax Official in Aqmola

- Aqtau Faces Power Outages Amid MAEK Equipment Issues

- President Signs Law on Governance, Infrastructure Development