Could New KASE Shareholders Also Face Sanctions?

On November 21, the Russian JSC Specialized Depository Infinitum was included in the latest US Treasury Department sanctions list, Orda.kz reports. Infinitum controls the mutual funds Levkoy and Nigella, which replaced the Moscow Exchange among the Kazakhstan Stock Exchange (KASE) shareholders.

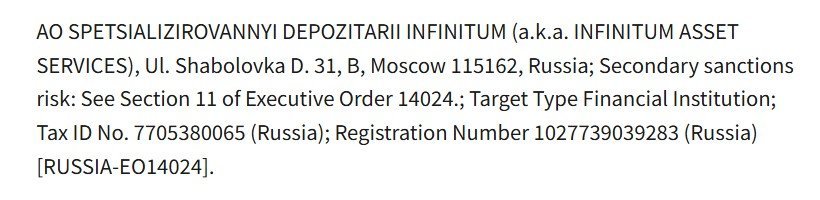

The specialized depository Infinitum was among the Russian financial institutions under US sanctions.

Accordingly, organizations working with it bear the risk of secondary sanctions.

Nigella and Levkoy are closed-end mutual funds that split MOEX's KASE share. A few months after US sanctions hit MOEX, the two funds received 8.5% (Nigella) and 4.6% (Levkoy).

The National Settlement Depository website of the Russian Federation indicates that Nigella and Levkoy are listed as being serviced by JSC Specialized Depository Infinitum. The depository was registered in Moscow in 2000, and its beneficiary is businessman Pavel Prass, who, according to media reports, may be connected to Vladimir Putin’s inner circle.

Strictly speaking, the US sanctions extend only to Infinitum and not against specific mutual funds that the depository services. Formally, there are no direct risks for KASE from this decision.

Even after the Moscow Exchange fell under sanctions, several months passed before its departure as a KASE shareholder.

Original Auhtor: Nikita Drobny

Read also:

Latest news

- Grave of Noble Nomadic Warrior Unearthed in Turkistan Region

- Kazakhstan Suspends Karachaganak Gas Plant Project With Foreign Partners

- Toqayev Opens CICA Headquarters, Highlights Importance of Diplomacy Amid Global Tensions

- Chinese Company Sinopec Launches 4.7 Billion Tenge Oil Drilling Project in Mangystau

- Ukraine's MoD Claims No Official Notice Received from U.S. on Munitions Suspension

- Azerbaijani Ministry of Science and Education Urges Caution Over Claims of Ending Russian-Language Education

- Alexander Lukashenko Pardons 16 People, Including Those Convicted of “Extremism”

- U.S. Reportedly Floated Corridor Deal via Armenia — Carnegie Report

- Orda.kz talks with Expert on Recent Escalations between Moscow and Baku

- Court Reviews Corruption Case Involving Samruq-Qazyna Subsidiary in Atyrau

- Claims Surface that Azerbaijan Plans to Close Russian-Language Schools

- Publishing House with Bomb Shelter Privatized in Almaty Returned to State Ownership

- 5,000 Dombra Players Set National Record in Taldykorgan

- A Piece of the Shoreline Pie: How Sarsenov Lost His Aqtau Land and Kulibayev’s Role

- Armenian Parliament Makes Initial Moves to Nationalize Electric Networks of Armenia

- Toqayev Orders Tighter Migration Control, Calls for Unified Digital Systems

- Kazakhstan: Forecasters Warn of Heavy Rains in the North, Scorching Heat in the South

- Who Writes the Rules? Trump’s Former Associate Discusses Kazakhstan’s Current Position with Orda.kz

- Omsk Governor Proposes Boosting Trade with Kazakhstan via Irtysh River

- Kazakhstan: Energy Officials and Executives Disciplined Over Sector Violations