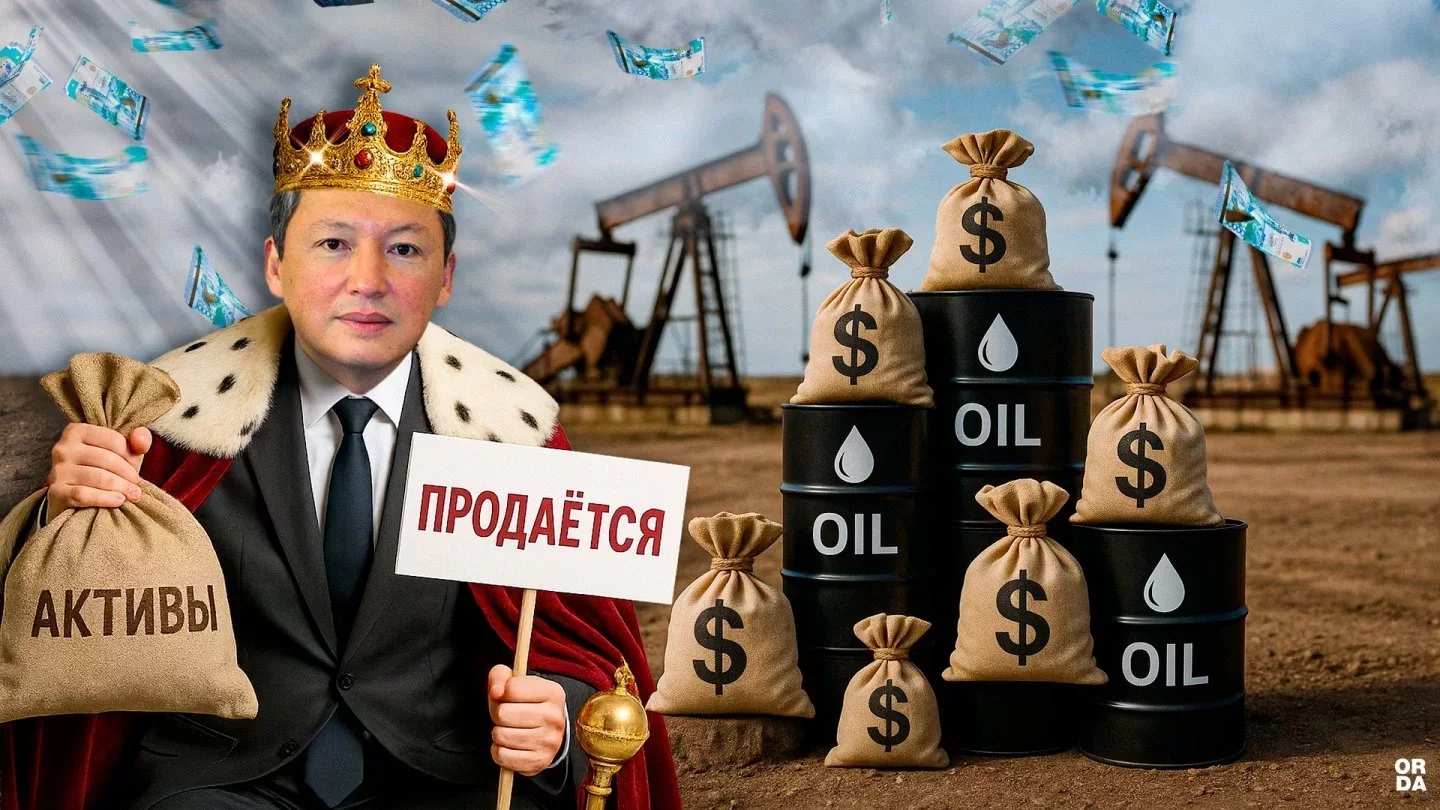

Will Timur Kulibayev Sell His Oil and Gas Assets?

Photo: Orda.kz

Photo: Orda.kz

At the end of August, some media outlets reported, citing unnamed sources, that one of Kazakhstan’s richest men, Timur Kulibayev, allegedly plans to exit the oil and gas sector and sell off his assets.

Orda.kz examined the issue with the help of an industry expert.

Rumor or Reality?

According to the reports, Kulibayev is considering selling his oil assets, primarily Caspiy Neft JSC, which operates the Ayrankol field in Atyrau Region. Speculation that the businessman — ranked second among the most influential figures in Kazakhstan’s oil and gas industry — might leave the sector is linked to the financial results of his holding, Joint Resources.

Through this joint-stock company, Kulibayev controls assets in coal mining, mineral exploration, energy, and oil, including Caspiy Neft and Crystal Management.

The results for 2024 were far from stellar. Joint Resources’ assets stood at 352.8 billion tenge, with total liabilities of 41.1 billion tenge, and the holding brought Kulibayev no profit. By July 1, 2025, liabilities had risen to 89.3 billion tenge, accounts receivable reached 51.9 billion, and net losses totaled 3.5 billion.

Caspiy Neft JSC itself posted total liabilities of 38 billion tenge in 2024, with net profit of 33.5 billion. The company also paid its top managers 159.4 million tenge for the year — about 13.3 million per month — but decided not to pay dividends for the second year in a row.

Crystal Management JSC performed even worse: in 2024, it reported modest revenues of 11.4 billion tenge and a net loss of more than half a billion.

Strictly speaking, Caspiy Neft accounts for only a small share of Kazakhstan’s oil output. The company is better known for the name of its owner and for receiving an environmental fine in 2024. Yet Kulibayev’s name carries enormous weight in the sector.

As the son-in-law of the first president, he led the Kazenergy association for many years and built a strong network of oil service assets, including KazStroyService.

Some experts dismiss the idea outright. They argue that Kulibayev’s oil and gas holdings are the foundation of his empire — without them, even Halyk Bank, which he controls and which actively lends to the industry, would lose its footing. Why would an oligarch abandon a field he knows so well, and where he has leverage?

Yet a closer look suggests the rumors may carry some weight. Even if talk of selling Caspiy Neft is just a “throw-in,” something bigger may be at play.

Which Assets Could Be on the Block?

Industry expert Abzal Narymbetov, author of the Energy Analytics Telegram channel, notes that Kulibayev controls three main assets in oil and gas: Caspiy Neft, Almex Plus, and Crystal Management (three, if we count Crystal Management Turbine, which operates a gas turbine power plant at the Aqshabulak field in Qyzylorda Region).

Caspiy Neft is developing Ayrankol. Almex Plus is exploring the Ansagan site in Atyrau Region’s Jylyoi District, where in 2023 it launched drilling of the Ansagan-5 well to a depth of 5,800 meters. Meanwhile, Crystal Management is working in the Qyzylorda Region at the Sulutaban field (Block A), where it plans to drill three new wells. On paper, Kulibayev’s assets have projects underway and long-term potential.

If Kulibayev were to offload unprofitable assets, the more likely candidate would be Crystal Management rather than Caspiy Neft. In Block A, only the Sulutaban site shows promise, and it has yet to move into active production. Oil officially extracted so far — from exploratory wells — has not exceeded 10,000 tons annually.

The prospects for Almex Plus at the Ansagan site are also uncertain. Exploration costs are high, potential returns are low, and there is no guarantee the investment will ever pay off.

In 2017, the field was discovered, and the fourth well was drilled. But according to the operational reserve calculation as of April 1, 2019, the indicators were very modest — seven million tons of condensate and about 12–17 billion cubic meters of dry gas. The hydrogen sulfide content is around five percent. At such depths, nearly six kilometers, to drill four wells and find so little is very disappointing. I am sure they have already spent $40–50 million on each of these wells. And there are four of them! To even begin recouping those costs, the recoverable reserves would have to be at least 90–100 million tons. In other words, this is no longer an asset but a liability. It will be difficult to sell — though initially they hoped it would be the second Tengiz, analyst Abzal Narymbetov explained.

According to him, the failure at Ansagan highlights the flaws of Kazakhstan’s approach to oil field development.

Instead of carrying out detailed calculations and weighing potential profits against inevitable costs, companies rush into areas of uncertain value. As a result, investment in the oil industry often proves inefficient. Kulibayev may well be weary of this picture.

In reality, Kulibayev cannot sell these assets now because the sunk costs are enormous, and no buyer would be willing to cover them. A buyer would only want to acquire the asset at market value. If Kulibayev’s team tries to sell the assets along with the accumulated costs, no one will take them. The only asset showing some life is Caspiy Neft. I believe Caspiy Neft will remain a promising company, Narymbetov said.

Why Sell Caspiy Neft?

Kulibayev has shed unprofitable companies before. In September 2024, he quietly sold his stake in Shubarkol Premium JSC to fellow billionaires Kenes Rakishev and Shukhrat Ibragimov. Caspiy Neft could, in theory, be the next company he parts with.

This is not the first time Timur Kulibayev has considered selling his assets. But if there had been a buyer, he likely would have already sold. Most likely, they could not agree on price. Of the three assets, only Caspiy Neft is profitable. Looking at its performance over the past five years, it has maintained steady production of about 900,000 tons and net profits of around 40 billion tenge annually — apart from the large fine in 2024, Narymbetov said.

The likelihood of a sale is higher because Caspiy Neft enjoys high margins, with production reaching roughly one million tons a year. For now, it is the only part of Kulibayev’s oil and gas empire for which he could be guaranteed to find a buyer.

“The only asset that can realistically be sold now is Caspiy Neft. But I have heard that water cut there is rising rapidly, production is declining, and the field is already entering depletion. Usually, it is very hard to sell such fields. But in Kazakhstan, most fields are already at the fourth, final stage of development,” Narymbetov concluded.

Ultimately, the effectiveness of any “oil and gas empire” depends less on whose money it was built with than on how competently it is managed. Experienced executives ensure costs are minimized and profits maximized.

In Kulibayev’s case, the opposite happened: the assets were overvalued and, in practice, turned into ballast.

By contrast, his appointees in other areas — such as finance and oil services — have shown much stronger management results. This is why personnel changes in his companies deserve close attention, as they may well be followed by major deals.

Original Author: Nikita Drobny

Latest news

- Russian Fighter Jet Makes Emergency Landing in Atyrau

- Kazakhstan’s Banks See First Early-Year Profit Drop Since the Pandemic

- Cyclone to Bring Snow, Rain, and Blizzards to Kazakhstan

- Investments, Aviation and Healthcare: Tokayev Holds Series of Meetings With U.S. Company Chiefs in Washington

- Kazakhstan Ready to Send Military to Gaza — Results of the «Board of Peace»

- Ex-Prince Who Sold a Mansion to Kulibayev Arrested in Epstein Case

- Almaty Will Not Build New Sports Facilities for the 2029 Asian Games

- Earthquake Recorded in Kazakhstan in 2020 May Have Been China’s Nuclear Test

- Kazakhstan May Move Constitution Day to March 15

- Kazakhstan’s Cinema Market: Kazakhfilm Fined, Kinopark Under Antitrust Scrutiny

- Kazakhstan Extradites Tax Fraud Suspect from Kyrgyzstan

- New 5.3-km Hiking Trail to Big Almaty Lake Planned for 2026

- Kazakhstan Introduces New Rules for Parcels Ordered from Foreign Marketplaces

- FlyArystan Appoints Executive from European Airline as CEO

- Freedom Bank Cancels Planned Kyrgyz Subsidiary After Shareholder Vote

- Kazakhstan’s Industry Sees Early-Year Slowdown

- Organizer of Multi-Billion-Tenge Online Casino Operation Brought to Kazakhstan

- Parents Oppose a Complete Ban on Smartphones in Kazakhstan’s Schools

- Tokayev and Japarov Exchange Support Amid Constitutional Reforms and Political Resignations

- Oskemen Recorded Over 1,000 Exceedances of Harmful Air Pollutants