The Kremlin’s Pill: How Russian Pharma Is Expanding Into Kazakhstan’s State Contracts

Photo: Orda.kz

Photo: Orda.kz

Kazakhstan has launched a new mechanism to attract investment into its pharmaceutical industry — investment agreements (IAs). The first company to receive priority access to government contracts was Khan Tengri Biopharma, a newcomer to the market whose founders include the Russian firm R-Pharm, linked to businessman Alexey Repik, described by Russian investigations as a “friend of the Putin family.” How did this happen — and how transparent are the rules?

Orda.kz investigated.

A Big Meeting

On September 17, at a meeting of the Investment Headquarters chaired by First Deputy Prime Minister Roman Sklyar, key terms of pharmaceutical investment agreements were approved. Among the first projects was the construction of a biopharmaceutical production plant worth more than 103 billion tenge.

Authorities present the initiative as a step toward boosting domestic production and creating new jobs.

But market experts warn that the lack of clear selection criteria for investors could result in preferential treatment for a small group of companies rather than promoting competition.

Who Is The First Beneficiary?

Khan Tengri Biopharma was registered on March 6, 2025, just months before appearing on the Investment Headquarters agenda. Officially, the company is developing a full-cycle biopharmaceutical complex in the Alatau Free Economic Zone — but no information is available about its production capacity or completed projects.

The State Revenue Committee lists its tax risk as medium.

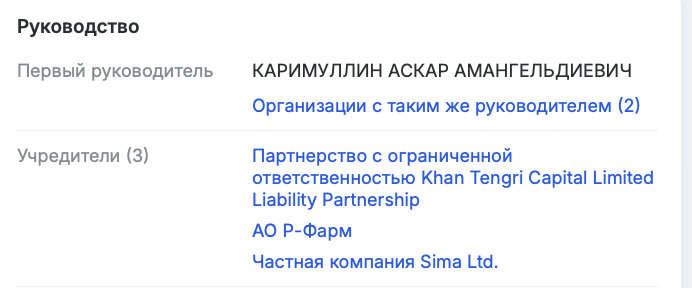

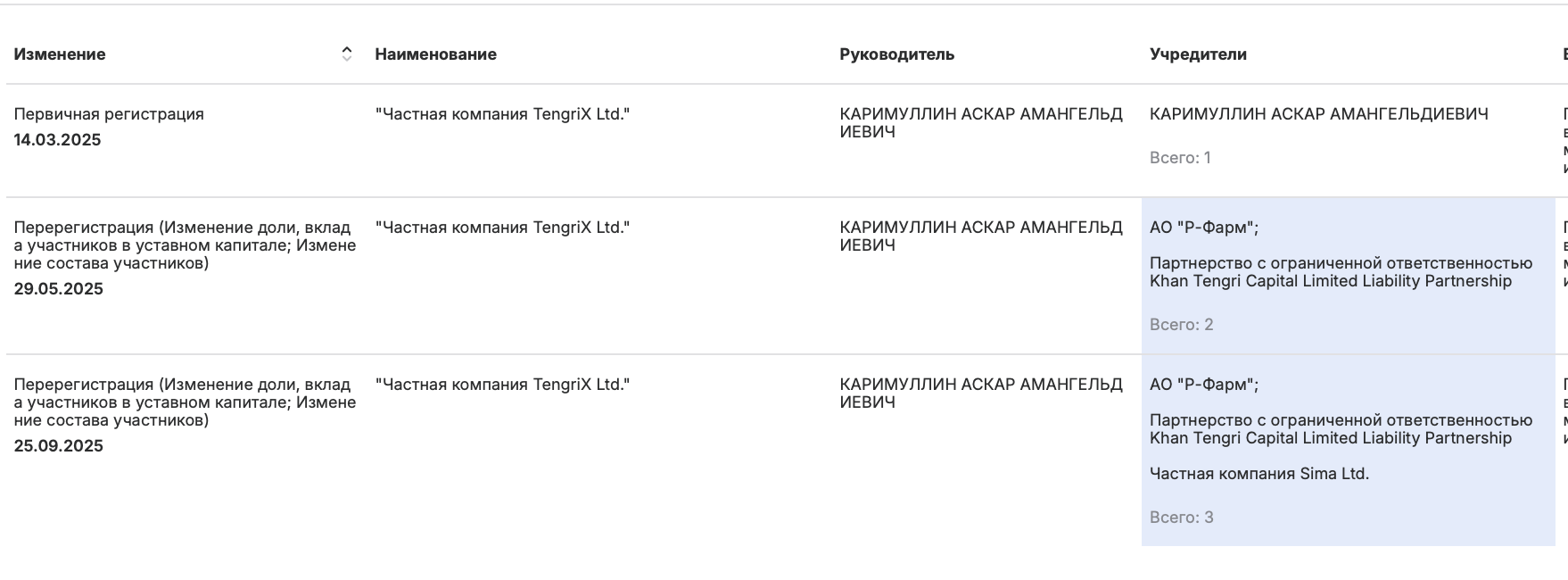

The company is led by Askar Karimullin, a former executive at Samruk-Kazyna Fund and BTA Bank. Until April 21, 2025, Karimullin was the sole founder, after which TengriX Ltd., also headed by him, joined as a co-founder.

TengriX Ltd. is co-owned by Khan Tengri Capital LLP, R-Pharm JSC, and Sima Ltd.

This is where R-Pharm enters the picture — a major Russian pharmaceutical company directly tied to Alexey Repik.

Repik, who was sanctioned by Western countries in 2023, is often described in Russian media as a close associate of the Putin family. R-Pharm is one of the largest suppliers of medicines to Russian state hospitals and has been active in Kazakhstan’s procurement market since 2024.

Earlier, Orda.kz reported that R-Pharm Kazakhstan was the sole participant and winner of the HPV vaccine tender worth over 17 billion tenge, facing no competition.

Interestingly, R-Pharm joined the Khan Tengri Biopharma project only in late May 2025. This raises a question: did the company join after Khan Tengri Biopharma had already received its priority status — or because of it?

The project envisions four construction phases — from laboratory and contract manufacturing to a logistics hub and GCP clinical center — covering 47 hectares. But given the lack of transparent selection criteria, the involvement of a company tied to a Russian pharmaceutical giant raises serious concerns.

How The State Procurement Works

Kazakhstan’s drug procurement is centralized through the Single Distributor SK-Pharmacy LLP.

There are four main procurement methods:

- Competitive tenders via the state web portal

- Single-source procurement (including via the portal)

- Purchases from domestic or foreign manufacturers, or through UN agencies

- Long-term supply contracts

Long-term contracts are the primary instrument of state support for the pharmaceutical sector.

Such contracts can be concluded either through competitive bidding among companies that establish or modernize production in Kazakhstan, or without bidding for patented drugs that have no analogues. Domestic and EAEU manufacturers also receive preferences — if they participate in a tender, bids from other suppliers are excluded.

What Is an Investment Agreement (IA)?

An IA is a state support mechanism for major projects with investments exceeding 7.5 million MCI (about 28 billion tenge). It provides investors with tax breaks, infrastructure, and the right to enter into long-term contracts without competition.

In his response, Zhanaidar Musin, Acting Managing Director and Member of the Management Board of SK-Pharmacy LLP, emphasized that he has no information about any decision by the Government of the Republic of Kazakhstan or the signing of an investment agreement with Khan Tengri Biopharm.

He also clarified that the current public procurement rules do not yet provide a mechanism for concluding a single-source supply agreement — that is, a direct contract without a competitive tender — with an investor participating in a special investment agreement.

Industry representatives note that bypassing competitive procedures violates the Ministry of Health’s procurement rules No. 110, dated June 7, 2023. They add that strict standards still apply to other market players — including requirements for proven experience, financial stability, and a clear commitment to keeping prices low.

Earlier, all long-term contracts were concluded only through open competition. A tender held on November 14, 2024, received 14 applications. But in February 2025, the Ministry of Health canceled it without explanation and soon introduced amendments enabling IA-based contracts.

Drafts circulated in spring and summer defined vague criteria — investment size, production localization, and a “first come, first served” rule. Ultimately, that rule decided it all, giving Khan Tengri Biopharma priority access to state orders.

But when did “first come, first served” become a strategic selection policy?

Changing The Rules

According to Ruslan Sultanov, a representative of the Association of Pharmaceutical Manufacturers, the new investment agreement model could reshape Kazakhstan’s pharmaceutical landscape.

From the government’s standpoint, this is standard practice. The IA tool is already used in other sectors, and now it’s being extended to pharmaceuticals to attract investment and stimulate new production, he said.

But in practice, Sultanov warned, the new model is far more restrictive.

The minimum investment threshold of 28 billion tenge excludes most local companies.

Not every company can invest that much. Projects require major capital and equipment. So far, nine companies have applied, and two more have shown interest, he explained.

He added that the lack of defined rules and criteria remains worrying:

Unlike the previous transparent tender system — with scoring and clear conditions — now the only criterion is being first in line. But the pharmaceutical market isn’t a store where you claim a spot just by standing in line. We need fair, transparent, and equal conditions.

While Sultanov acknowledges that investment agreements can be effective, he cautioned against monopolization.

So far, there are more conditions than answers. For Special Investment Agreements to truly work, the rules must be clearly defined, lobbying must be eliminated, and fair competition ensured. The agreements should cover only the medicines that the investor will produce at the site — not those imported from abroad. And the terms of these agreements must be transparent.

Still Pending

According to Kazakh Invest, the Khan Tengri Biopharma project was submitted for review by the Ministry of Health. The ministry assesses project feasibility and prepares an industry evaluation before forwarding materials to the Investment Headquarters.

The agency clarified that Kazakh Invest does not decide which projects are approved — it only processes investor applications. The Khan Tengri Biopharma project was simply the first application received, and therefore reviewed first.

No investment agreement has yet been signed; the project remains under interagency review.

Response from The Ministry of Health

Orda.kz sent the ministry 11 questions regarding transparency and selection criteria.

The reply provided no direct answers, instead reiterating the regulatory framework. The ministry also failed to clarify whether sanctions risk checks were conducted on Khan Tengri Biopharma’s founders, given that R-Pharm owner Alexey Repik remains under international sanctions.

Returning to the few specifics mentioned in the response, the Ministry of Health reported that in 2025, it received nine applications for the conclusion of Special Investment Agreements (SIAs), totaling 398.2 billion tenge. The projects cover 246 types of medicinal products, including an initiative by Khan Tengri Biopharma, which plans to build a full-cycle biopharmaceutical complex in the Alatau Special Economic Zone.

The ministry noted that the SIA process is regulated by the Entrepreneurship Code and several bylaws, including Government Resolution No. 312 of May 17, 2022, and Order No. 11-1-4/113 of the Ministry of Foreign Affairs dated March 17, 2023.

In order of priority, the ministry will form a working commission to negotiate the conclusion of Special Investment Agreements (SIAs), which will include representatives from the Ministry of Foreign Affairs, Ministry of National Economy, Ministry of Finance, Ministry of Industry and Construction, the National Company Kazakh Invest, QazIndustry, and others. Upon completion of the commission’s work, the draft SIA will be submitted to a meeting of the Investment Headquarters. If both the commission and the Investment Headquarters reach a positive decision, all procedures required by law will be completed, and SIAs will be signed with the respective companies, the response states.

While no agreements have yet been signed, the lack of transparent rules will determine whether “privileged” foreign companies gain a foothold in Kazakhstan’s market.

And one question remains: does this not contradict the drug security policy President Qassym-Jomart Toqayev has repeatedly emphasized?

The president has called for increasing the domestic share of medicine and medical device production to 50%, yet the current trajectory risks putting the industry under foreign control.

Original Author: Maria Kravtsova

Latest news

- Moscow, Washington, and Kyiv Clash Over Terms of Possible Ukraine Ceasefire

- Azerbaijan and Kazakhstan: President Aliyev Arrives in Astana

- Kazakhstan: Musicologist and Honored Artist Yuri Aravin Passes Away at 85

- Village Akim and Police Major Convicted of Bribe Scheme in Pavlodar Region

- Kazakh Gas Output Falls After Drone Strike on Russian Plant

- Armenian Anti-Corruption Committee Arrests Gyumri Mayor and Officials on Bribery Charges

- Old Faces, New Addresses: Why Abayev Is in Moscow and Atamkulov in Tashkent

- Air Astana Faces Boeing 787 Delays as CEO Peter Foster Prepares to Step Down

- Baku Releases Sputnik Azerbaijan Director Igor Kartavykh

- Supporters of Samvel Karapetyan Protest in Yerevan

- Kazakhstan Completes Highway Linking Russia and China

- Protesters Arrested in Tbilisi After Blocking Rustaveli Avenue

- How Gadji Gadjiev and His Associates Came to Lead Kazakhstan’s Strength Sports Federations

- Which Oligarchs Will Take Over Kazakhstan’s Football Clubs

- Yury Dud Explains Why He Wants to Visit Kazakhstan But Can’t

- Experts Explain Why Toqayev’s Tax Breaks Won’t Save Businesses

- Over 2 Billion Tenge in Public Funds Stolen from East Kazakhstan Construction Projects

- Orenburg Plant Fire Disrupts Processing of Kazakh Gas; Domestic Supply Remains Stable

- Almaty Region Teenagers Filmed "Sexual Acts" with 13-year-old Girl, Investigation Underway, Evidence Points to Simulation

- Qaraganda Businesswoman Faces Over Four Years in Prison for Alleged Incitement of Ethnic Discord