Nearly 1.5 Trillion Tenge Already Spent From Kazakhstan’s National Fund in 2025

Photo: Elements.envato.com, ill. purposes

Photo: Elements.envato.com, ill. purposes

In just the first three months of 2025, Kazakhstan has already spent close to 1.5 trillion tenge from its National Fund. Meanwhile, the plan for tax collections into the National Fund has been met by only 13%, nearly half the rate of the same period last year, Orda.kz reports.

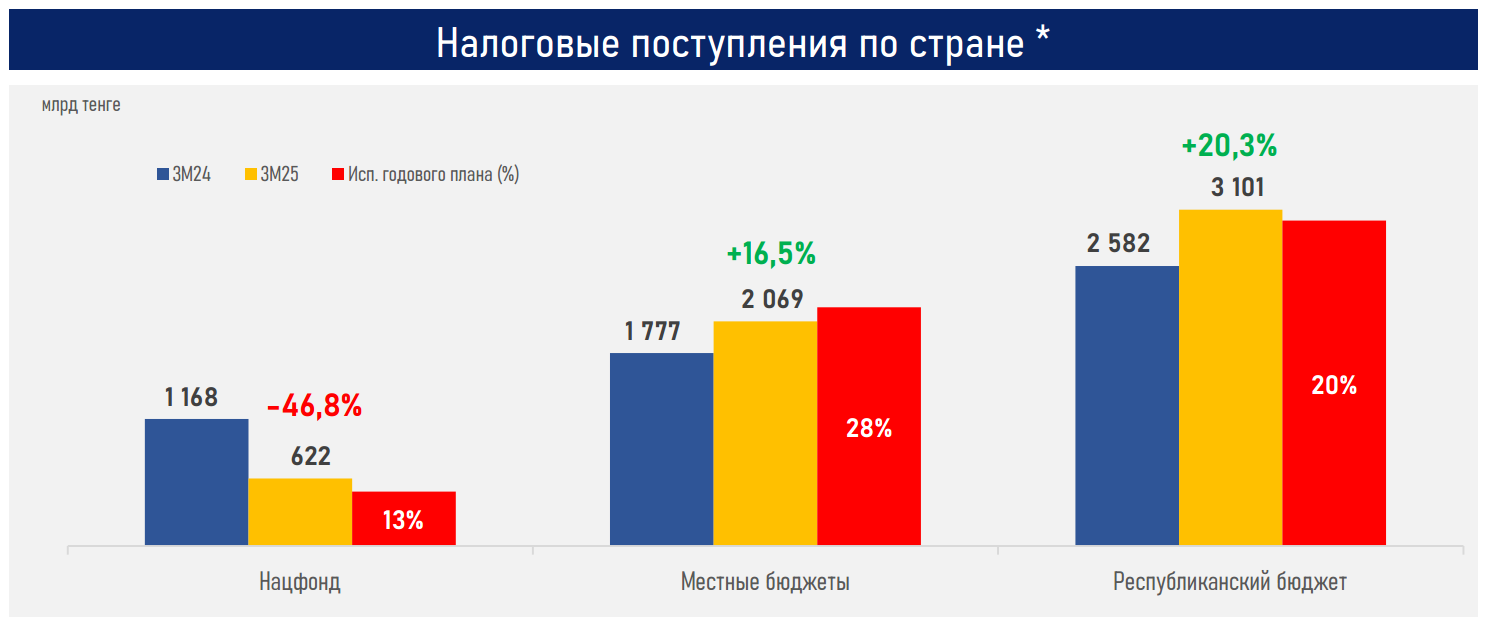

According to analysts from the Association of Financiers of Kazakhstan (AFK), total tax collection across all government levels — the National Fund, the republican budget, and local budgets — reached 5.8 trillion tenge in the first quarter of 2025, marking a 4.8% increase compared to the same period last year.

However, most of that growth came from the republican and local budgets, while tax revenues flowing specifically into the National Fund dropped sharply.

In fact, the National Fund collected just 547 billion tenge in taxes in Q1 — a 47% decline from last year.

Despite this drop, it remained the top revenue source as the government withdrew 1.45 trillion tenge from its reserves, outpacing the republican (520 billion) and local budgets (292 billion).

“The National Fund has seen a decline across all major tax categories. The sharpest falls were in the mineral extraction tax (down by 85 billion tenge) and corporate income tax (down by 378 billion tenge), largely due to lower average oil prices. As a result, the tax collection plan for the National Fund is only 13% fulfilled, compared to 25% at this point last year,” AFK analysts noted.

On the other hand, VAT revenues to the republican budget rose 13%, and corporate income tax collections jumped 28%, improving the overall national tax collection rate from 19.9% last year to 21.1% this year.

Despite stronger tax performance outside the National Fund, it hasn’t been enough to cover all budget gaps. To help finance the growing deficit, Kazakhstan took on 1.5 trillion tenge in new loans early this year, part of an annual borrowing plan of 8.3 trillion tenge. Treasury spending exceeded revenues by 857 billion tenge.

To keep the budget afloat, the government has also continued its familiar practice of drawing from the National Fund. For 2025, 5.25 trillion tenge in National Fund transfers are planned, and 1.45 trillion tenge has already been used. Given the low oil prices and sharply declining tax revenues, it’s likely that the National Fund will experience a decrease in 2025.

AFK’s forecasts paint a worrying picture. In the first quarter, the National Fund received only 622 billion tenge, or about 43% of the amount withdrawn. Meanwhile, Kazakhstan’s debt could rise to 37.2 trillion tenge, or 24.7% of GDP.

Given this outlook, AFK analysts stress the need for better management of state assets, faster privatization of investment-attractive holdings, and stronger efforts to combat the shadow economy.

Original Author: Nikita Drobny

Latest news

- Kazakhstan Seeks Solutions to Ease Pressure on Uzbek Terminals Amid Export Surge

- Georgia’s Security Service Says No Evidence of “Kamit” After BBC Report

- Kadyrov Confirms Drone Damage to Grozny City

- Russia Temporarily Blocks Kazakhstan's Grain Transit, Threatening Flax Exports to Europe

- Assets of Businessman Dulat Kozhamzharov Seized Following Halyk Bank Claim

- Georgian Opposition Calls December 6 March Over Alleged Use of Chemicals at 2024 Protests

- Severe Smog Covers Oskemen

- Fire and Structural Damage Reported at Grozny City Tower Amid Drone Threat

- Pashinyan Says Foreign Influence Networks Exposed

- Kazakhstan-Based Lukoil Assets Could End Up in Hungarian Hands

- Strong Tenge Pushes Some Banks to Temporarily Stop Issuing Dollars

- Investigation Links Baimsky Project to Nazarbayev's "Wallet," Vladimir Kim

- Three Kazakhstani Nationals Arrested in Georgia Over Alleged 10,000-Ton Oil Theft

- Turkistan Region Contract for 100 Million Tenge Video Project Triggers Scrutiny

- Gennady Golovkin Becomes First Kazakhstani Honored by the International Boxing Hall of Fame

- Former Majilis Deputy Says She Was Stripped of Mandate After Criticizing Authorities

- Mangystau Authorities Investigate Death of Worker Who Fell Into Elevator Shaft

- Golovkin at World Boxing: How Kazakhstan and Saudi Arabia Are Building a New Power Structure in Boxing

- Taraz: Sentences Extended for Defendants in Group Sexual Assault Case

- Taliban Carry Out Public Qisas Execution After Teenager’s Family Killing