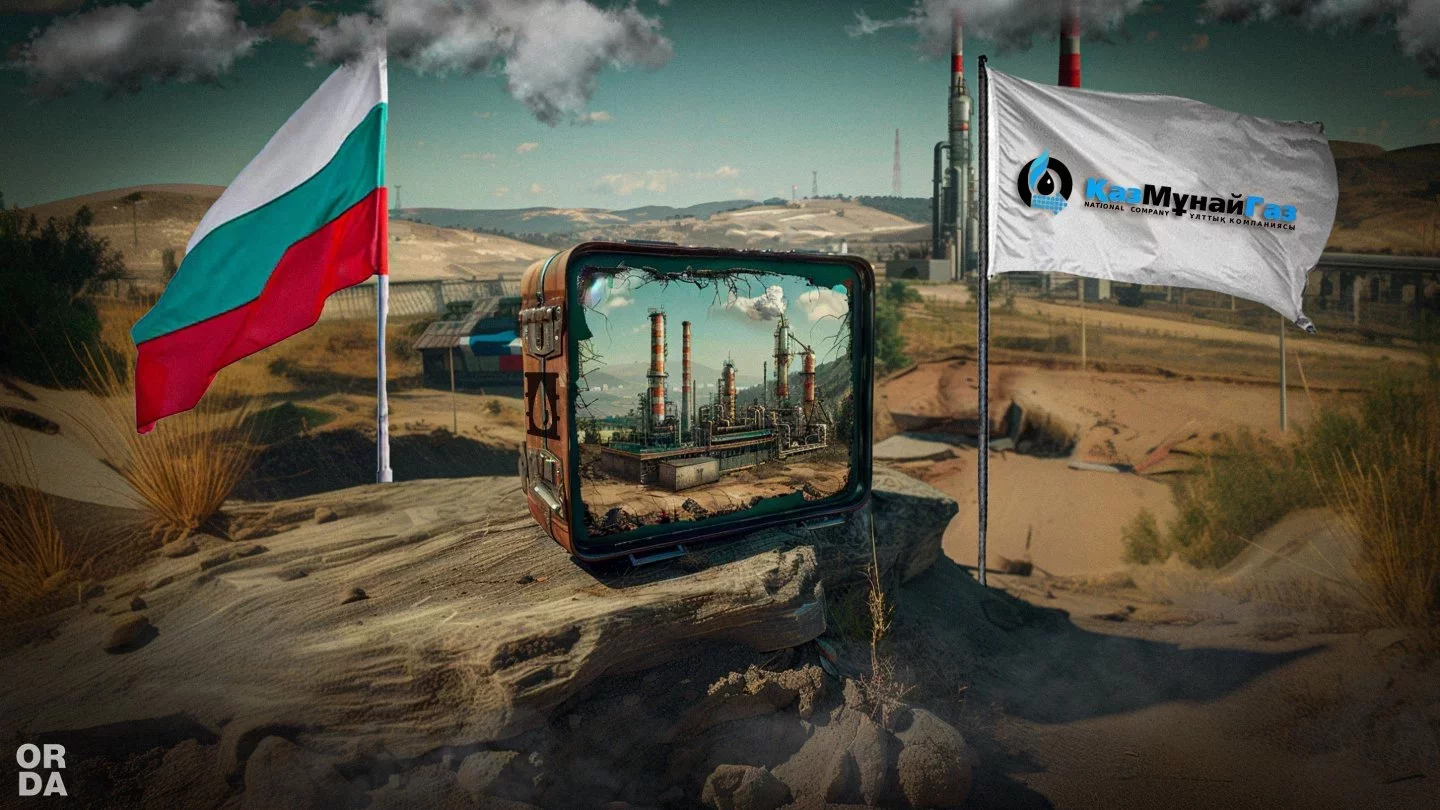

Kazakhstan Eyes Bulgarian Refinery Purchase: Opportunity or Risk?

Kazakhstan's national oil company, KazMunayGas (KMG), may acquire Lukoil's refinery in Burgas, Bulgaria, for approximately one billion dollars.

The potential purchase comes as Russian energy companies face increasing pressure from EU sanctions.

Orda has looked into the matter

A Good Fit

The Burgas facility, Bulgaria's only refinery and the largest in the Balkans processes 196,000 barrels of oil daily. 91% of its output is gasoline and kerosene.

Currently receiving oil from Kazakhstan, Iran, and Tunisia, the refinery is well-suited for processing Kazakhstan's crude without requiring significant modifications.

Despite rumors of the company dropping out, KMG confirmed its interest in the facility:

The Lukoil company has invited JSC NC KazMunaiGas to participate in a tender for the acquisition of the Lukoil Neftokhim Burgas refinery in Bulgaria. The details are being discussed. Given KazMunayGas's ownership of two refineries in Romania — Vega and Petromidia (KMG's share is 54.63%) — this will expand the company's capabilities in the international energy market.

BNN Bloomberg claims the price tag is a billion dollars, although KMG has not officially named any figures.

Meanwhile, oil and gas analyst Abzal Narymbetov highlights the strategic value:

The Burgas plant supplies domestic and regional markets, with the possibility of sea export via the Rosenets port. The strategic location near the Black Sea supports access to both oil imports and refined product exports.

He further emphasizes the potential impact:

From 196,000 barrels per day (seven million tons per year), KMG's total refining capacity in the EU will increase to 12 million tons per year. Access to the Rosenets port diversifies supply routes and enhances export opportunities. The refinery's compatibility with Kazakh oil will ensure a stable market for Kazakhstan's resources and optimize logistics.

However, the seemingly attractive price raises questions.

To assess the fairness of the billion-dollar price, it is important to compare it with similar deals on the world market. The Antipinsky refinery (Russia, 140,000 barrels per day) was sold for $1.5 billion, but it was in a difficult financial situation. The Burgas refinery has a higher capacity and modern technology, which can increase its estimated value. But sanctions and restrictions reduce the refinery's attractiveness to buyers. Narymbetov explains:

According to the analyst, Lukoil could provide a loan to facilitate the purchase, similar to the ISAB plant sale in Italy.

There may be potential concessions on KMG's part for the discounted price.

One possibility is granting Lukoil rights to explore and develop oil and gas fields – effectively exchanging European refinery assets for access to Kazakhstan's oil resources.

The refinery could still solidify KMG's position in European markets.

On the other hand, Kazakhstan will have to provide refineries with reduced production plans.

If domestic raw materials are insufficient, alternative raw materials from the Middle East or other compatible grades can be used.

The deal will give KMG a competitive advantage over rivals such as MOL and SOCAR, strengthening its role in the European energy market. Despite the existing challenges, including possible regulatory pressure and logistical adjustments, the strategic benefits outweigh the risks, Abzal Narymbetov notes.

Repeat Scenario?

KMG's track record in European acquisitions adds another layer of complexity.

The company's 2007 purchase of Romania's Petromidia refinery for 2.7 billion euros has faced numerous challenges, including allegations of tax evasion and fraud, asset freezes, and operational issues.

April 2024 complaints from Rompetrol employees about management practices and a $270.5 million loss in 2023 further underscore these concerns.

Whether the Burgas acquisition would strengthen Kazakhstan's energy sector or become another challenging asset in the company's portfolio remains.

Original Author: Nikita Drobny

Latest news

- FSB Employees Reportedly Detained in Police Operation at Sputnik Office in Baku

- Kazakhstan: Law Banning Face-Covering Clothing in Public Receives Presidential Signature

- President Signs Law on Territorial Defense

- Kazakhstan: AntiKor Offers Reward for Information on Fugitive Ex-Judge

- Almaty Region Official Accused of Land Fraud

- Former Justice Minister Beketayev Sentenced to Nine Years in Prison

- Kazakhstan Merges Anti-Corruption Agency into National Security Committee

- Kazakh Human Rights Activist Claims Surveillance in Montenegro, Investigation Underway

- Kazakh Prosecutors Send Perizat Kairat's Fraud Case to Court

- New Transport Minister Receives Instructions

- Russian Comedian Living in Kazakhstan Accused of Inciting Ethnic Hatred By Russian Authorities

- Digital Nomad Residency: One Applicant Shares Experiences of Bureaucracy and Technical Glitches

- Lavrov Asserts Kazakhstan and Russia In Contact Over Claimed UAV Flight Over Republic

- Health Ministry Not to Pursue Legal Action Over SAC Audit Report

- Week In Review: Arrests, Sentences, Appointments, and More...

- From Corruption to Classrooms: What Happened to Kairat Satybaldyuly’s Seized Assets

- Former KTZ Head Nurlan Sauranbayev Appointed Kazakhstan’s Minister of Transport

- Indian Developer to Invest $500M in Medical University and Hospital Projects in Kazakhstan

- Drought and Delays: Talgar District Farms Struggle Without Irrigation Water

- Verny Capital Sells RG Gold to China’s Zijin Mining Group