How Realtors and Notaries Help Cybercriminals Seize Apartments in Almaty

Photo: Orda.kz

Photo: Orda.kz

Pensioners in Almaty have fallen victim to an international criminal group, losing their apartments, savings, and even taking on debt. The perpetrators were professionals — and they had help from realtors in Almaty and beyond. Some victims say police are stalling the investigation, Orda.kz reports.

On September 25, Honorary Architect of Kazakhstan Yelena Shchedrina held her second solo protest outside the Almaty Prosecutor’s Office. She tried to draw public attention to what she considers law enforcement’s passive efforts in pursuing a gang of real estate scammers.

Yelena was defrauded and lost around 100 million tenge in property, including real estate.

She says neither the police nor the prosecutor’s office is interested in holding the scammers accountable.

In addition to Yelena Shchedrina, others lost their apartments under a similar scheme. Police have not disclosed how many people were defrauded by cybercriminals.

In the Bostandyq district alone, five known apartments were sold through deception and threats. Victims have been forced to find each other, unite, and search for evidence themselves.

In every case, apartment sales were shifted from criminal to civil proceedings, and civil courts refuse to invalidate sham contracts or rule against buyers considered “bona fide” under the law. Even when signs of a fraudulent transaction — deception, threats, and psychological pressure — are obvious, apartments are always sold far below market value.

One such case involved Galina Turkina, a lonely elderly woman in Almaty, in January 2024. She was called by someone posing as an employee of Home Credit Bank, who first scared her by claiming someone had already taken out a million-tenge loan in her name.

He then reassured her, saying the bank’s security service and the police were already tracking the scammer, that a special operation was underway, and that if she wanted to recover her money and stay in her apartment, she had to follow their instructions. Everything then followed a familiar pattern.

Galina’s confidant, Marina Bazarevskaya, told Orda.kz that Turkina transferred the amounts as instructed. That is how she ended up with a loan of about six million tenge. The same thing happened with her apartment. The very next morning, she was told that it had been “put up for sale and sold behind her back.”

Frightened — because it was her only home — she followed instructions from her “protectors” and sold the apartment within a week, believing it would save her.

And then the investigation began. But neither the police nor the civil court recognized her as a victim in the sale of the apartment. The police also refused to investigate the fraudulent loans. They said they had no authority to inspect banks for leaks of personal data or check their scoring systems, which are supposed to prevent loans to insolvent citizens,Bazarevskaya said.

Repeated requests to the police for an independent forensic analysis of the selfie used for online lending went nowhere. As in other cases, Galina had to obtain her own bank statements, a handwritten transcript of her calls, and WhatsApp messages — though the investigator was obligated to do so, with notarization.

Investigators showed no interest in her phone. It was neither seized nor examined. The only questioning of the realtor involved in the criminals’ transaction relied solely on her own testimony. Her phone was also not examined, Bazarevskaya said.

Despite remarks made by Police Department representative Saltanat Azirbek on Eurasia Channel program shortly before Galina’s forced eviction, none of the “top cyber police specialists” ever worked on the case.

The head of the investigative department of the Bostandyq District Police Department said, “We’ve sent them your case several times, but they’ve always returned it.”

The head of the Almaty City Police Department, responding to complaints during a personal meeting, said, “You’re working with the best specialists at the Bostandyq District Police Department. You have a new investigator.

He’ll call you tomorrow.” All this was relayed by Marina.

The meeting with prosecutors took place in June. Four months have passed since then, and no one has called. Oddly enough, we’re neither surprised nor upset—we’ve grown used to the constant lies and empty promises from law enforcement. A year and a half after the incident, we are forced to admit: the police, judges, and prosecutors have done nothing to protect the rights of the victim. The perpetrators have not been found — it was said from the start they likely never would be — they remain unpunished, they are growing bolder, and the number of such crimes is rising, she emphasized.

Victims claim the police conceal facts and even suppress publicity by forcing them to sign non-disclosure agreements, warning of criminal liability if they speak out. Turkina received such an order. As a result, victims are afraid to challenge the police, forced to trust their promises, and remain silent—until they find themselves homeless.

Then the police simply say: “We tried our best. We did everything we could. You were evicted by a civil court decision. That has nothing to do with us!”

Law enforcement, victims say, has a well-established system: purchase-and-sale contracts are separated from criminal cases and moved into civil court, where judges rule only on the legality of the transactions. The fact that a seller is recognized as a victim in a criminal case has no bearing on the civil proceedings.

Police also prefer victims to sue the so-called money mules in civil court, because until recently, money mules could not legally be prosecuted — they were treated only as witnesses.

'In this way, criminal offenses are covered up by civil proceedings,' Marina said. 'And ultimately, the criminal case is shelved—that’s what happened with Galina’s case. It’s in the archives, and Galina is homeless. Victims are left at the mercy of civil proceedings, forced to file lawsuits, pay lawyers and enormous state fees based on multimillion-tenge claims, and recover paltry sums from money mules, who are often victims themselves.'

Another victim is Rakhima Shaikieva. Now retired and undergoing chemotherapy, she is registered at an oncology clinic and classified as a second-degree disabled person.

In November 2024, her former employer messaged her on WhatsApp, warning that the Anticorruption Service was interested in her, that a KNB officer named Captain Tokbayev would call, and that she must respond but not tell anyone.

Shaikieva then received a call from someone posing as a KNB officer, who claimed a transfer of 1.8 million tenge had been sent from her account to Ukraine to finance terrorism.

Soon, another caller introduced himself as investigator D.A. Baykulov of the Almaty KNB Department. He told her to check her deposits and stay in touch via the BCC app. She had six million in deposits and two million in her pension account at the bank.

Then came another call, this time from a woman claiming to be Luiza Anufrieva of the National Bank’s financial control department. She told Shaikieva her pension account held only 11,324 tenge instead of two million, and her deposit had just 32,567 tenge instead of over six million.

The scammers tricked her further, claiming the state would soon transfer money back to her accounts. She was told to withdraw the funds and deposit them into another account via a terminal at the ADK shopping center —supposedly to help catch criminals.

They then told her the fraudsters had obtained her personal information and that they were trying to sell her apartment, though the transaction was not complete. To prevent this, Shaikieva was instructed to sell the apartment herself for cash through a realtor. A man named Medeu Bakyt bought it for 38 million.

Throughout the ordeal, the scammers stayed on her phone line, guiding her step by step and warning her not to share details of the “operation” with anyone.

Other victims suffered similar losses: 72-year-old Bakhyt Baytanayeva lost property worth 53 million tenge, while Valery and Nadezhda Narayev lost their two-bedroom apartment valued at about 40 million.

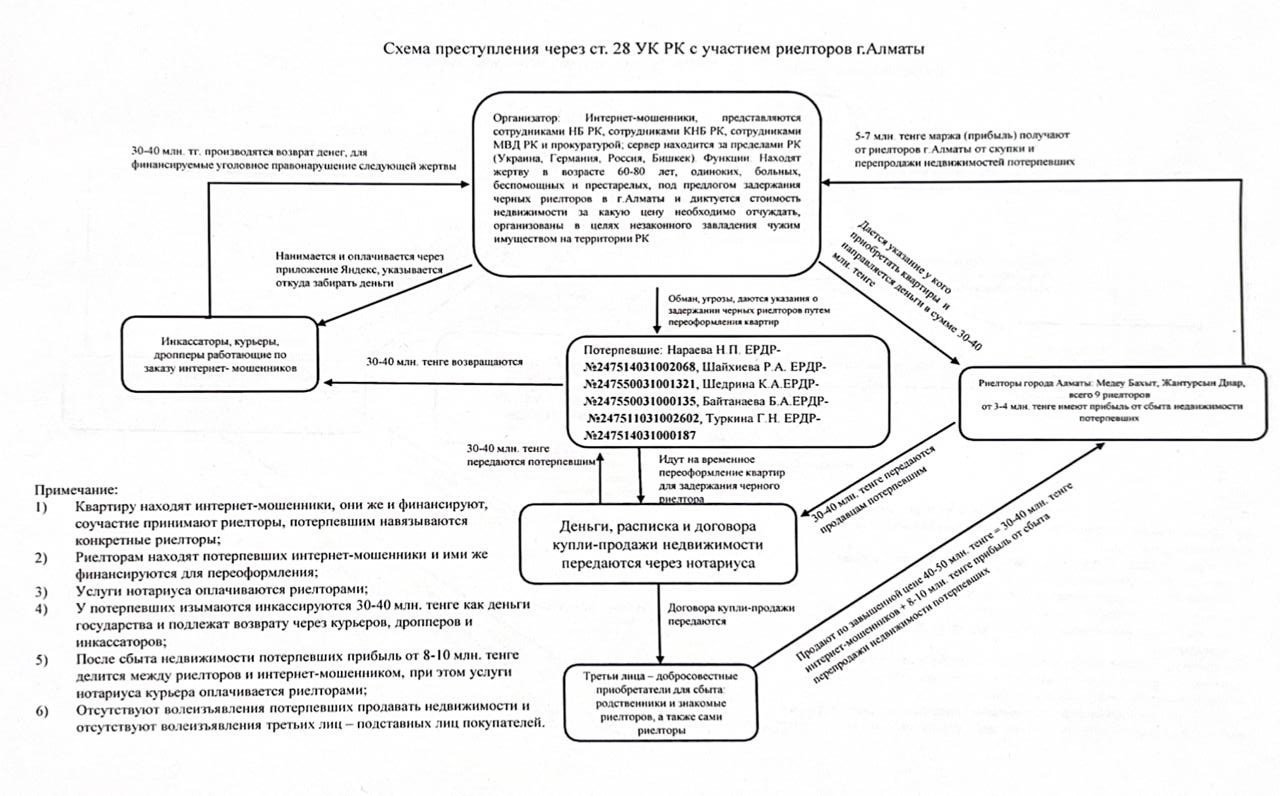

What all these cases reveal is that this is not the typical quick scam where a fraudster calls, misleads the victim, and disappears. It is a complex scheme involving paperwork and an entire network of accomplices — Almaty realtors, straw buyers, notaries, couriers, and money mules, who provided their accounts and cards for cash withdrawals. For their role, they received payouts amounting to millions of tenge.

Some perpetrators have been identified, but they were questioned only as witnesses and then released. Victims insist these individuals are accomplices in the criminal schemes—and that certain realtors even profited significantly from them.

Akhan Raimkulov, a lawyer representing the victims, told Orda.kz about this.

Raimkulov conducted his own investigation and found that the same realtors appear in every case. Yet none of them have been detained.

For this reason, both the victims and their lawyer believe Almaty investigators have little interest in pursuing or arresting the fraudsters.

The lawyer has submitted a statement to the prosecutor, naming the Almaty realtors allegedly involved in the scams.

In his statement, he noted that when criminal cases are registered, investigators list only the money as the subject of the crime — not the real estate itself. According to him, this loophole gives fraudsters, particularly realtors, de facto immunity from prosecution and helps legitimize the results of fraudulent deals.

Orda.kz’s editorial team has submitted an official inquiry to law enforcement agencies.

Original Author: Danil Utyupin

Latest news

- Kazakhstan Maintains Neutral Stance on Middle East Escalation

- Kazakh MFA: Citizens Evacuated from the Middle East via Oman and Saudi Arabia

- Kazakhstan to Spend 4.6 Trillion Tenge on Road Projects Through 2029

- Central Asia Competes for the Skies: Why Kazakhstan Risks Falling Behind Uzbekistan on Jet Fuel

- The War in Iran Opens a Window of Opportunity for Kazakhstan’s Oil Sector, Analysts Say

- Iran Conflict Escalates Beyond the Gulf: What Kazakh Experts Say About Risks for Central Asia and Kazakhstan

- Kazakhstan Prepares Possible Evacuation of Its Citizens From Iran

- LRT in Astana Is Reaching the Finish Line: The Launch Is Expected in the Coming Months

- Kazakhstan Ready to Help the UAE Amid Escalation in the Region

- Tokayev Discusses Middle East Escalation With Qatar’s Emir

- Airlines Ready to Bring Kazakhstanis Home From the Middle East

- Tokayev Sends Support Messages to Gulf Leaders Amid Regional Escalation

- Kazakhstan Bans Its Airlines From Flying Over Several Middle East Countries

- Astana Strengthens Security Measures Amid Escalation Around Iran

- Tokayev Meets U.S. Ambassador Stufft, Discusses Board of Peace Cooperation

- Mangystau Launches AI-Assisted School Monitoring to Prevent Teen Suicidal Behavior

- Kazakhstan to Supply UK With Critical Minerals

- AI Faculties for Educators to Open in Kazakhstan: What Other Changes Are Coming to the Education Sector

- There Are Medals — But Not Enough Ice: What’s Happening to Figure Skating in Kazakhstan

- Is Kazakhstan’s Nuclear Power Plant Project at Risk After New UK Sanctions? Rosatom Responds