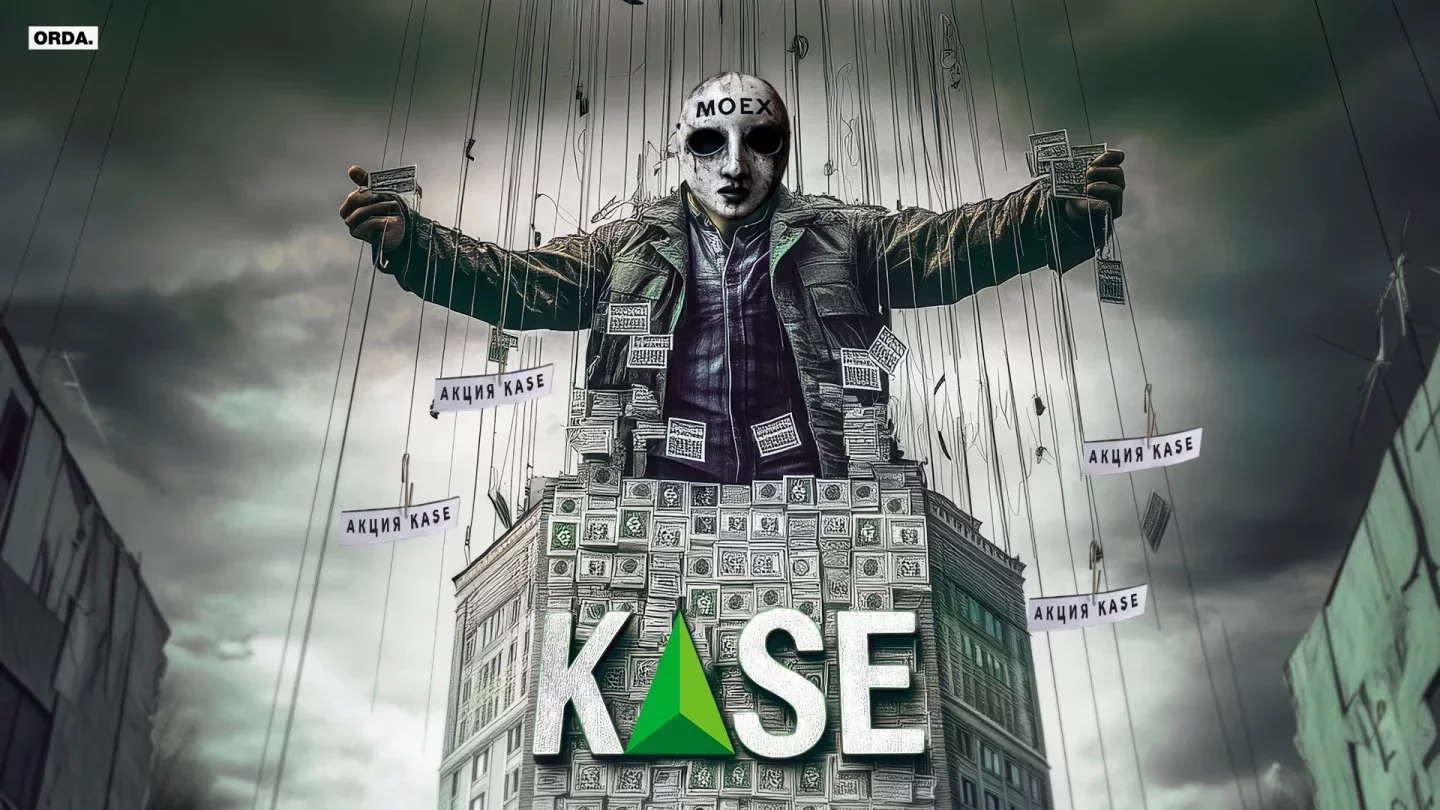

KASE Moscow Exchange Deal Explained

Photo: Orda

Photo: Orda

In the summer of 2024, the Moscow Stock Exchange (MOEX) fell under US sanctions. The exchange previously owned 13.1% of the shares of the Kazakhstan Stock Exchange (KASE). MOEX recently left the KASE shareholder group, yet peculiarities accompanied its departure. Orda.kz has looked into the situation.

Tip of The Iceberg

In June, reports emerged that the Moscow Exchange had been subject to sanctions. At that time, KASE announced that this would not affect its operations. KASE, however, clarified that sanction risks would be an element for consideration.

In October, MOEX decided to part ways with KASE. Two Russian closed mutual investment funds later replaced it. Levkoy received 4.6% of the shares previously owned by MOEX, and Nigella received 8.5%.

Russian financial market participants with Moscow registrations manage both of them. The company that manages the Levkoy fund is the principal co-owner of the Russian football club CSKA, which is also under American sanctions.

Almost nothing else is known about the funds, causing the deal to seem dubious.

What we see on the surface is a change in the nominal holder. Previously, it was the Moscow Exchange, but now, since MOEX is under sanctions and had to be removed from the list of shareholders, these shares had to be transferred to someone. In fact, it is clear that through one or two handshakes, these mutual funds can be affiliated with the Moscow Exchange - but at least not directly, says economist Arman Beisembayev .

Peculiar People

KASE cannot verify who controls the Russian funds. These organizations may or may not be associated with MOEX.

KASE, even if it really wanted to know who is behind these mutual funds, would not be able to do so - that is why they are closed investment funds. They were created according to Russian law and have the absolute right not to disclose the composition of their shareholders and structure, says financial analyst Andrey Chebotarev.

Open sources provide almost no detailed information about Nigella and Levkoi, but some connections can still be traced. The Russian National Settlement Depository website lists them as serviced by the Russian JSC Specialized Depository Infinitum, a depository organization that stores securities, registers transactions with them, and tracks information about transactions.

Infinitum was registered in Moscow in 2000 with a charter capital of 45 million rubles. The CEO and beneficial owner is businessman Pavel Prass, an energy specialist by education, a financial market participant by profession, and a mountain climber and yachtsman by hobby. Russian media claims he also has connections to Russian President Vladimir Putin's inner circle.

Pavel Prass is a relatively little-known businessman. During his 30-year career in the financial market, he has given virtually no interviews, only occasionally making exceptions for specialized media, and has not been involved in major scandals. Verstka wrote that Prass participated in the deal to buy out Yandex's Russian business.

Verstka traced the connections of the specialized depository Infinitum with Gazprombank and the pension fund Gazfond, whose major shareholders are Vladimir Putin's close friend Yuri Kovalchuk and the Russian president's nephew Mikhail Shelomov. In 2021, Pavel Prass also acquired a company from the ex-husband of Vladimir Putin's youngest daughter that controlled 0.5% of the shares of the large oil and gas company Sibur.

Pavel Prass's other engagements include public-private partnerships in the housing and utilities sector. According to Russian media, in the late 2010s and early 2020s, he had business interests in St. Petersburg, Krasnodar Krai, Volgograd, Nizhny Novgorod, Novosibirsk, Saratov and Samara Oblasts. These interests were mainly related to concessions.

We cannot confirm that the JSC Specialized Depository Infinitum is directly related to the transaction to transfer KASE shares, but this organization serves Levkoy and Nigella as a depository. This means it will be the one to monitor the securities transferred.

24 Hours

Financial analyst Andrey Chebotarev emphasizes that the deal to change the nominal holder of KASE shares happened very timely.

October 12 was the deadline for its execution without formal approval from US regulatory authorities. A day before the expiration, the Moscow Exchange share was transferred to Nigella and Levkoy. No complicated approvals were required.

After sanctions were imposed on the Moscow Exchange, its 13 percent stake in KASE became subject to sanctions. To sell it to someone after a certain time (in this case, after October 12), the explicit permission from the Americans would have been needed. And this was pulled off because there simply was no time to find a real buyer, says Andrey Chebotarev .

It is unclear why the National Bank did not buy the shares. Such a turn of events could have solved many potential issues. The two investment funds may simply be intermediaries.

The arrangement may be much more complicated than it seems. Perhaps, first, the Moscow Exchange gave its shares to these investment funds, and the funds will then transfer this block of shares to another person. I suspect that these mutual funds are temporary holders, and this block of shares will be transferred to someone else. I do not think that this is some kind of disguise for the Moscow Exchange. Even if there is, then from a legal point of view - based on the documents - this is not so, notes Arman Beisembayev.

Economist Arman Beisembayev says the main result is that secondary sanctions no longer loom over the Kazakh exchange, for now.

As long as these mutual funds are not under sanctions, we are not threatened by secondary sanctions either. No one prohibits us from coming into contact with the Russians directly, which means there are no grounds for secondary sanctions. Yes, these two investment funds are Russian. But for now, no one is going after them, and if something is not prohibited, it is allowed. If suddenly these funds fall under sanctions, then the share package will probably be sold to someone else - some other funds, or a foreign investor will appear. Or these mutual funds will return shares to KASE itself. So I do not see any risks here in terms of secondary sanctions, at least direct ones.

Arman Beisembayev

The economist admits that KASE shares may return to the Moscow Exchange, yet their return is hinged on the geopolitical situation and whether MOEX remains under sanctions.

Apparently, the Moscow Exchange does not want to let this block of shares to go very far. This means that it either has some information or some expectations. Perhaps the Moscow Exchange has in mind a scenario in which the war ends in 2025, and after that, one of the steps by the US will be lifting sanctions on MOEX. Then the Moscow Exchange will be able to calmly get back its block of shares and become a KASE shareholder again, suggests Arman Beisembayev.

Similarly, Western corporations, which began to leave Russia en masse in 2022, transferred their businesses to Russian companies, but with the condition that they could repurchase them within five years. The Moscow Exchange may have the same strategy.

In fact, KASE has nothing to lose. All this looks, to put it mildly, distasteful - but so does 13% of the sanctioned organization in the capital. KASE needs to get rid of this share - and, apparently, it was not possible to do it in any other way. So let's wish KASE good luck and hope that soon the oldest Kazakhstani exchange will dissociate itsel with those sanctioned, Andrey Chebotarev sums up.

Original Author: Nikita Drobny

Latest news

- 2,500 Participants from 22 Countries: Almaty Opens the Running Season

- Snow and Frost: Weather Forecast for February 15

- Tokayev congratulates Serbia’s President Vucic on Statehood Day

- Mikhail Shaidorov Wins Kazakhstan’s First Winter Olympic Gold Since 1994

- Indian Crested Porcupines Spotted by Camera Trap in Ile-Alatau National Park

- Kazakhstan’s Air Pollution Isn’t Driven by Factories — Ministry of Ecology

- How the US Views Kazakhstan’s Constitutional Reform and Free Speech

- US Ambassador to Kazakhstan: Visa Restrictions for Kazakhstanis Are a Temporary Measure

- China-to-Russia Shipments Are Increasingly Bypassing Kazakhstan

- Shokan Ualikhanov Private School Reclassified as Large Business After Staff Tops 250

- Former Priest Yakov Vorontsov Reportedly Detained in Kazakhstan

- Kazakhstan Proposes Differentiated Toll Rates for Transit Foreign Drivers

- World Bank Ready to Provide Kazakhstan Up to $1 Billion a Year for Six Years

- Woman Forced to Move and Change Jobs Repeatedly as Ex-Husband Stalked Her

- Kazakhstanis Are Getting Married Less Often

- Why Online Voting Isn’t Coming for the 2026 Referendum

- Mephedrone lab network uncovered in Almaty’s private houses

- Kazakhstan’s Domestic Trade Slows in January

- A Man Spent Six Months in Jail for Nothing — Court Awards Millions from the State

- Over 100M Tenge in Budget Money Allegedly Spent on Gambling in West Kazakhstan