Is Moscow Extending Reach to Kazakhstan's Oil?

Russia has never hidden its interest in Kazakhstan's oil and gas sector. Orda.kz has looked into recent events surrounding the situation.

Lukoil Blues

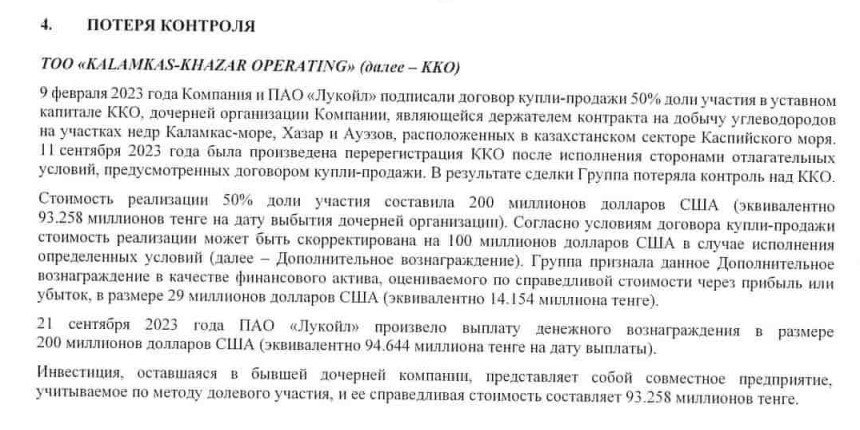

Russian investors have indeed been eyeing Kazakhstan's oil fields. Lukoil, a prominent Russian investor in Kazakhstan, purchased 50% of the subsidiary of KazMunayGas — Kalamkas-Khazar Operating LLP (KKO).

KKO is engaged in the production of hydrocarbons in Auezov, Kalamkas-Sea, and Khazar in the Caspian Sea. The deal, as it turned out, occurred in 2023, although information about it emerged only after the publication of KMG's financial statements.

KazMunayGas hastened to clarify, assuring that the national company had not lost control of the field development project. At the same time, KMG's financial statements indicate the corresponding section as "loss of control".

The Kalamkas-Sea and Khazar fields were previously part of various subsurface use contracts with various operators. The operator of the Kalamkas-Sea was NCOC, the company developing the Kashagan field, the operator of Khazar — KMOK with the participation of Shell and Oman Oil companies. For a number of reasons, their development was delayed, including due to the lack of economic feasibility of independent operation. As a result, the companies declined to invest in their development and returned the plots to the state,

KMG said.

The development of these fields was combined into one contract and transferred to Lukoil. Lukoil is already engaged in similar projects in the Russian sector of the Caspian Sea. KMG claims that the project would not have caught anyone else's attention. At the time of the transfer of KKO, the company was not generating profit. Moving forward, Lukoil, as the investor, will deal with this.

Kazakhstani political scientist and expert on international relations, Anuar Bakhitkhanov, believes that Lukoil's arrival in Kazakhstan's fields is a natural phenomenon.

The acquisition of a stake in the Kalamkas-Khazar Operating company by the Russian oil giant Lukoil is a previously planned process for the development of the Kalamkas-Sea, Khazar, Auezov fields. According to KMG's management, the project is complex, it is planned to attract investments of five to six billion dollars. In this regard, Lukoil has become a suitable partner for KMG. There are reservations in the agreement: if the company falls under sanctions, the participation of the Russian company will be discontinued. This applies not only to this project, but also to many others, says Anuar Bakhitkhanov.

The political scientist notes that the terms are beneficial for KazMunayGas. It would be unprofitable to develop fields in the Caspian Sea independently.

In my opinion, in the conditions of modern realities (the budget deficit speaks for itself), international partnership is a necessity. However, the benefits of such cooperation should be openly explained to the public in detail,

Anuar Bakhitkhanov

Meanwhile, business analyst and energy sector expert, Abzal Narymbetov, author of the Telegram channel "Energy Analytics", believes that there are both advantages and disadvantages.

The advantages are that there are several oil fields on the part of the Russian sector of the Caspian Sea, which are combined into one area. When you combine several fields, this way you reduce the cost of production — one pipeline and one primary refinery are used. Kalamkas and Khazar are close to these fields. Lukoil's plan is probably to create synergy between them and its fields in the Russian sector, to process and export oil using the infrastructure of Russian fields. The disadvantages are that the current supply of fuels and lubricants to the Kazakh domestic market is decreasing annually. In the future, demand will be even higher. In fact, Kalamkas and Khazar will now be tagged for export using Lukoil's infrastructure. Most likely, Kazakhstan will not be able to count on oil volumes from these fields as additional ones, as fuel consumption is growing, whereas production is falling at all but three fields, says Abzal Narymbetov.

The second disadvantage, according to the expert, is that Kazakhstan will now be even more dependent on Lukoil's infrastructure located on the territory of Russia, thus amplifying its vulnerability.

Sanctions against Russia are also a noteworthy point. If Kazakhstan decides to create joint ventures with the Russian Federation, their threat will be ever so present.

Russian companies cannot obtain Western technologies, especially for deep drilling and spare parts for equipment used in factories. Of course, Kazakhstani companies can get them. But if these are joint productions, there will be a risk of falling under secondary sanctions. The fields still require technologies that are available in Western countries, notes Abzal Narymbetov.

Fake News, Pro-Russian Lobby

Lukoil having taken over a company from KMG structures is not surprising: the Russian corporation already has shares and joint ventures in projects to develop oil fields in Tengiz, Karachaganak and Kumkol. Attempts to shake up already strained relations between Kazakh authorities and Western investors are also a notable aspect.

At the end of March, the Russian company Lorett, registered at the Moscow innovation center "Skolkovo", claimed that there was an oil spill at the Kashagan field in the Caspian Sea. The company cited satellite images as evidence. Some Kazakhstani eco-activists hurried to share the information. The news turned out to be fake, however.

The NCOC consortium, Kashagan's operator, hastened to verify Lorette's claim. Helicopters were lifted into the air, and international experts studied seawater in a laboratory. No oil slick was found. The satellite presumably captured a natural phenomenon. The timing of the disinformation is nevertheless a cause for curiosity.

Relations between the Kazakh authorities and Kashagan's foreign investors have worn thin. The state demands compensation from the consortium for environmental damage amounting to almost five billion dollars and is actively suing NCOC in international instances. If, in such a situation, the Western shareholders of Kashagan, led by the Italian Eni, refuse to continue participating in the project, will Lukoil take their place?

Coincidentally, an appeal appeared simultaneously with Lorette's disinformation. A few deputies and activists made it. They suggested that the Oil and Gas Council under the President address the foreign shareholders of Kashagan and other Kazakh fields and ask them to exchange their shares for frozen Russian assets confiscated by the EU authorities. Why Kazakhstan needs to make such a convoluted maneuver is a question that the activists themselves are unlikely to answer honestly.

The deputies' initiative has perplexed experts. They note that the decision to freeze Russian assets and where to send them is a matter of foreign policy relations between the European Union and the Russian Federation. Kazakhstan is not a factor.

This arrangement, in my opinion, is difficult to implement and risky because the implementation of this proposal may involve the leadership of Kazakhstan in a serious political scandal. At first glance, the revision of shares in existing Kashagan projects is an excellent initiative, and this will help to negotiate a signed bonus of $15 billion concerning the nuclear power plant that the Russian side plans to build on the territory of Kazakhstan. But Western investors and participants in oil projects, obviously, will not enthusiastically welcome this proposal, said political analyst Anuar Bakhitkhanov.

The fate of key fields should be decided at the state level and in favor of one's own country, not someone else's.

First, it should be clearly stated that the frozen Russian assets are Russian, not Kazakh. The Kashagan, Karachaganak, and Tengiz fields are the property of Kazakhstan, the subsoil belongs to the people according to the Constitution. Kazakhstan has the priority right to decide who will own these assets. Secondly, the licenses for these fields ( for foreign investors - Ed.) will end soon, and after that, they will completely move to the state balance sheet. There, the state will decide who to give shares to for the further development of these fields, concludes Abzal Narymbetov.

Drones Flying — Reserves falling

Russia is now forced to import petroleum products due to attacks by Ukrainian drones on Russian refineries. These attacks have cut the production of petroleum products in Russia by about 14%. The country's need for fuel has gone nowhere, though, thus explaining Moscow's increasing interest in Kazakhstan.

On April 8, Reuters wrote, citing its sources, that Russia allegedly requested Kazakhstan to create a reserve of 100 thousand tons of gasoline for supplies to the Russian Federation in case of a shortage. The Ministry of Energy of the Republic of Kazakhstan denied this.

To date, no such request has been received from the Ministry of Energy of the Russian Federation. Therefore, the information is unfounded, said Shyngys Ilyasov, Advisor to the Minister of Energy.

Considering Reuters' report as another attempt by Russia to misinform is plausible. Moscow has tried to pull neutral Kazakhstan into its conflict with Ukraine. Misleading claims had already appeared that drones, which attacked Russian refineries, had been launched from the territory of the Republic of Kazakhstan.

Russia may be experiencing a fuel shortage, but choosing to seek help from Kazakhstan, also experiencing a shortage of petroleum products along with its self-imposed restrictions on their exports, seems illogical.

But making neighboring countries resource appendages is a familiar strategy for Russia. Moscow may try to do so with Kazakhstan. And in a peaceful way — through investments. If Shell and Eni are unwilling or unable to develop Kazakh fields, why not Lukoil, to the great satisfaction of the Kremlin?

Experts emphasize that there is nothing wrong with foreign (even Russian) investors. On the contrary, it gives the necessary impetus to the economy. Nonetheless, it is vital not to get hung up on cooperation with a single partner and extract maximum benefits for the domestic industry.

It is necessary to create joint ventures with local companies so that Kazakhstani companies receive experience, technologies, expand financial opportunities so that over time they can export this experience abroad. In general, you should always be open to investments, but act taking into account risk factors. Kazakhstan does not need to be overly one-sidedly dependent — it seems to me that it is advisable to diversify each industry so that investors come from different countries, including attracting local investors. So that they share their experience, use modern technologies, innovations, and employ local and highly qualified foreign specialists. Foreign investors have easier access to loans, why not use it to develop local companies? says business analyst Abzal Narymbetov.

According to political scientist Anuar Bakhitkhanov, the conventional perception of Kazakhstan as a raw material appendage of the "powerful of this world" is unfortunate. But this does not mean that foreign investments should be abandoned.

If it brings benefits and time to transform the economy in order to get rid of dependence and the oil needle, in my opinion, this is an imminent step for positive changes, says Anuar Bakhitkhanov.

Foreign investors nevertheless work in Kazakhstan for profit, bearing in mind the foreign policy interests of their states. Sharing technologies and creating new jobs is not free of charge.

It is becoming increasingly difficult for independent and neutral Kazakhstan to maintain a balanced policy in the current global predicament. The country has thus far managed to maintain it. A total handover of strategic sectors, such as oil and gas used as a lever of influence, could very well be problematic.

Original Author: Nikita Drobny

DISCLAIMER: This is a translated piece. The text has been modified, the content is the same. Please refer to the original piece in Russian for accuracy.

Latest news

- Oil Smuggling Trial Begins in Aqtau Over Seized Tanker

- Armenian Foreign Ministry Open to Outsourcing Transport Corridor Oversight

- A Second Kazakhstan-Born Individual Convicted of Treason in Russia This Month

- National Fund Council: Toqayev Receives Tie-Breaking Vote Power

- Kazakhstani Caught With Fake Passport in Bulgaria Fears Extradition

- Rubio and Lavrov Hold Talks at ASEAN Summit Amid Escalation in Ukraine

- Asset Recovery: Price on De Beers Earrings Cut by 23 Million Tenge

- Pashinyan and Aliyev Discuss Normalization Efforts in Abu Dhabi

- What Will Be Considered Stalking? The Ministry of Justice Explains

- Kazakhstan Prepared to Build Karachaganak Gas Plant With Alternative Contractor if Needed

- Former Russian Orthodox Priest Launches Petition for Constantinople Church Presence in Kazakhstan

- Asset Recovery and Management Company Launches New Auction for Land in Nazarbayev’s Hometown

- Olzhas Bektenov Discusses Digital Innovation and Travel Safety with Yandex Qazaqstan

- Man Detained over Attempted Arson at House of Ministries Entrance

- Producer Says Zemfira Concert Canceled Due to Poor Planning

- Kazakhstan's Energy Minister Comments on Russia–China Gas Pipeline via Kazakhstan

- UN Working Group Says Gulnara Karimova Was Arbitrarily Detained, Uzbekistan Responds

- Perizat Kairat Claims Abuse in Detention

- U.S. Senate Considers Julie Stufft for Ambassador to Kazakhstan

- Leviathan vs. Orda: Gulnara Bazhkenova Speaks Out on Efforts to Seize Her Media and Threats to Her Life