Saudi Arabia May Boost Oil Production Over Quota Breaches by OPEC+ Members

Illustration generated by DALL-E

Illustration generated by DALL-E

The Kingdom is considering ramping up production in response to quota violations by other OPEC+ members, including Kazakhstan, Orda.kz reports.

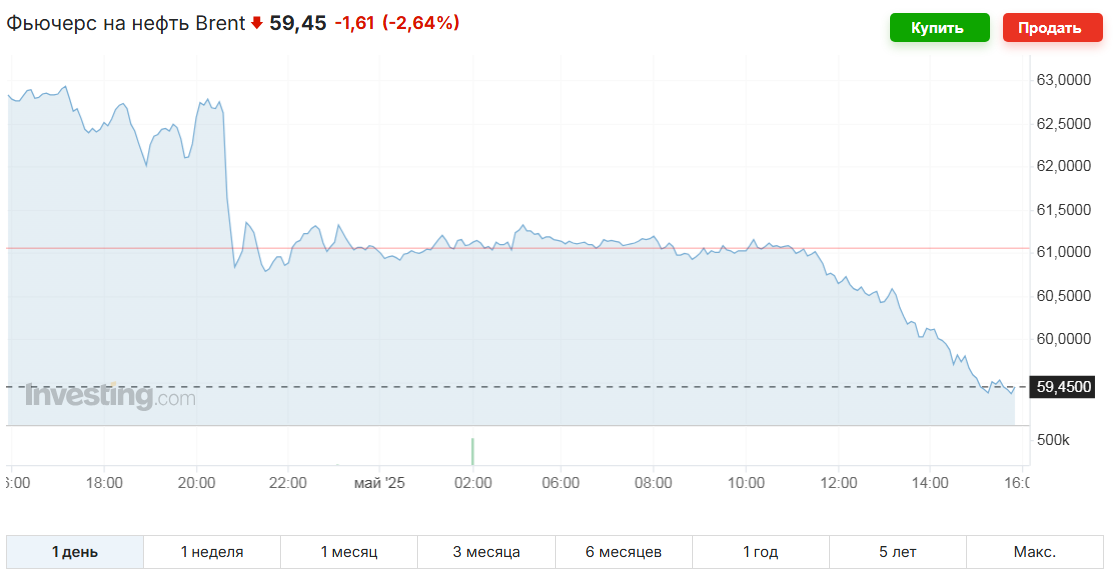

Global oil prices dropped sharply following reports from Reuters and Bloomberg that Saudi Arabia plans to change its approach within the OPEC+ agreement. Rather than supporting high prices through voluntary cuts, Riyadh may announce an increase in output starting in June, possibly as early as next week.

American WTI crude fell nearly 4% on the news, and July Brent futures slipped below $60 per barrel, losing over 2.5% in one day.

Saudi sources indicate that the kingdom’s budget can withstand a prolonged price decline, affording it the flexibility to act. One scenario under consideration is increasing production to recover market share lost in recent months, as Saudi Arabia has adhered to — and in some cases exceeded — its production cuts.

According to Bloomberg, Saudi Arabia is pushing for a significant increase in OPEC+ supplies, partly in response to countries such as Kazakhstan, the UAE, and Iraq that continue to overproduce beyond agreed-upon limits.

Political factors may also be at play, with reports suggesting that Washington is pressuring Riyadh to help bring down global fuel prices.

Energy expert Bob McNally, president of Rapidan Energy Advisers and former White House adviser, told Bloomberg that historically, when OPEC+ leaders choose to use supply increases as leverage, they tend to follow through decisively.

Back in April, OPEC+ had already moved to accelerate its planned exit from voluntary cuts, adding 411,000 barrels per day, equivalent to three months of scheduled increases. That decision was seen as an early signal that the group might shift from market support to defending its share.

In March, Kazakhstan once again exceeded its limit, partly due to the Tengiz field expansion. Should a new price war erupt, similar to the 2020 crisis, Kazakhstan could face declining revenues and increased export risks due to global oversupply.

Original Author: Ruslan Loginov

Latest news

- Kazakhstan Bans Its Airlines From Flying Over Several Middle East Countries

- Astana Strengthens Security Measures Amid Escalation Around Iran

- Tokayev Meets U.S. Ambassador Stufft, Discusses Board of Peace Cooperation

- Mangystau Launches AI-Assisted School Monitoring to Prevent Teen Suicidal Behavior

- Kazakhstan to Supply UK With Critical Minerals

- AI Faculties for Educators to Open in Kazakhstan: What Other Changes Are Coming to the Education Sector

- There Are Medals — But Not Enough Ice: What’s Happening to Figure Skating in Kazakhstan

- Is Kazakhstan’s Nuclear Power Plant Project at Risk After New UK Sanctions? Rosatom Responds

- Prosecutor General’s Office Suspends Extradition of Navalny Ex-Staffer Detained in Almaty

- Former EBRD Executive Jürgen Rigterink Elected as New Independent Director on Bank RBK’s Board of Directors

- Kazakhstan Near Bottom of Retirement Comfort Ranking

- Kazakhstan to Open New International Flights Across Asia, the Middle East and Europe

- Foreign Experts Paid 47 Times More Than Local Scientists in Kazakhstan

- Almaty Utility Services Clear Streets for Fourth Time After Continuous Snowfall

- The Deputy Calls for Checks on Kazakh Officials Named in Epstein Files

- Su-30SM Fighter Jet Crashes Near Karaganda

- School Smartphone Restrictions May Expand Beyond the Classroom

- US warns Ukraine against strikes affecting CPC oil exports

- Kazakhstan and Austria Agree on Readmission of Illegal Migrants

- Digital Rating for Military Commanders Proposed in Kazakhstan