Head of Fraud-Accused “Tender Exchange” Speaks Out About the Scheme and Unpaid Debts

Photo: Orda.kz

Photo: Orda.kz

Earlier, Orda.kz published an investigation into the activities of “Tender Exchange” — a scheme that, according to victims, cost hundreds of Kazakh citizens millions of tenge. The man at the center of the story is entrepreneur Chingis Kurmangaliyev, the brother of Almas Kurmangaliyev, who was convicted in the Mudarabah Capital pyramid case.

During preparation of the first report, Orda.kz attempted to contact Chingis for comment, but he did not respond. After publication, however, he reached out to the newsroom himself to share his side of the story.

What Kurmangaliyev Says

Chingis insists that he did not deceive anyone and that many investors did, in fact, receive payments. Moreover, he claims that some earned “three times more” than they invested.

I have payment slips, bank statements, and payment orders. For example, there’s one family that invested 100 million and received 360. And they also filed a complaint. Why do you think that is? he said.

He admits that his company has been in a prolonged crisis since 2024 but maintains that he continues to win tenders and publish reports. According to him, he is still returning funds to those who have not gone to the police.

One of Kurmangaliyev’s main arguments is the existence of payment orders that allegedly confirm repayments. However, victims previously told Orda.kz that these documents were issued when contracts were extended — without any actual money being paid.

There are people I haven’t paid back in full. But there are also those who’ve worked with me for years. Why do they think everything they received was profit, not repayment? Chingis asks.

When asked why people who had received payments are now filing police reports, he replies:

When someone was receiving profits for two years, spending it, buying a car — they considered it their earnings. But when the crisis hit, they decided it was just bonuses. So they started filing complaints. But the law says otherwise.

Kurmangaliyev also says he urged investors not to take the issue public.

I warned them. I asked not to involve third parties. But they went to the police. That’s it — now it’s a criminal case. I’m not a prosecutor, not a judge, not an expert. The law decides.

He also emphasizes that he doesn’t believe he owes anyone the promised interest.

The investigators ask two questions: how much did you receive? How much did you return? The difference is the damage. No interest is taken into account. That’s not my rule — that’s the law, he says.

Chingis claims he initiated a “private audit” and promised to share the results with Orda.kz. However, despite repeated assurances, no documents have been provided. After several follow-up attempts, he again stopped responding to messages.

What Lawyers Say

According to lawyer Ilmira Nazyrova, if the loan agreements explicitly include interest, that interest must be repaid along with the principal. But if investigators prove that the contracts were used to collect money from the public under promises of profit, the scheme would qualify as a financial pyramid. In that case, the interest and profits would not be recoverable.

In such cases, these agreements are considered void under Article 157 of the Civil Code, and only the actual sums invested can be recovered — without interest or profit. Moreover, any activity involving the management of investors’ funds or promises of income requires a license and is subject to oversight by the Agency for Regulation and Development of the Financial Market. Operating without a license means the company is acting outside the law, and such activities may be classified as illegal banking or microfinance operations, the lawyer explains.

However, in most — if not all — of Kurmangaliyev’s agreements with investors, the interest rate was never written down. There were only verbal promises of about 10 percent every two months. Such arrangements have no legal force.

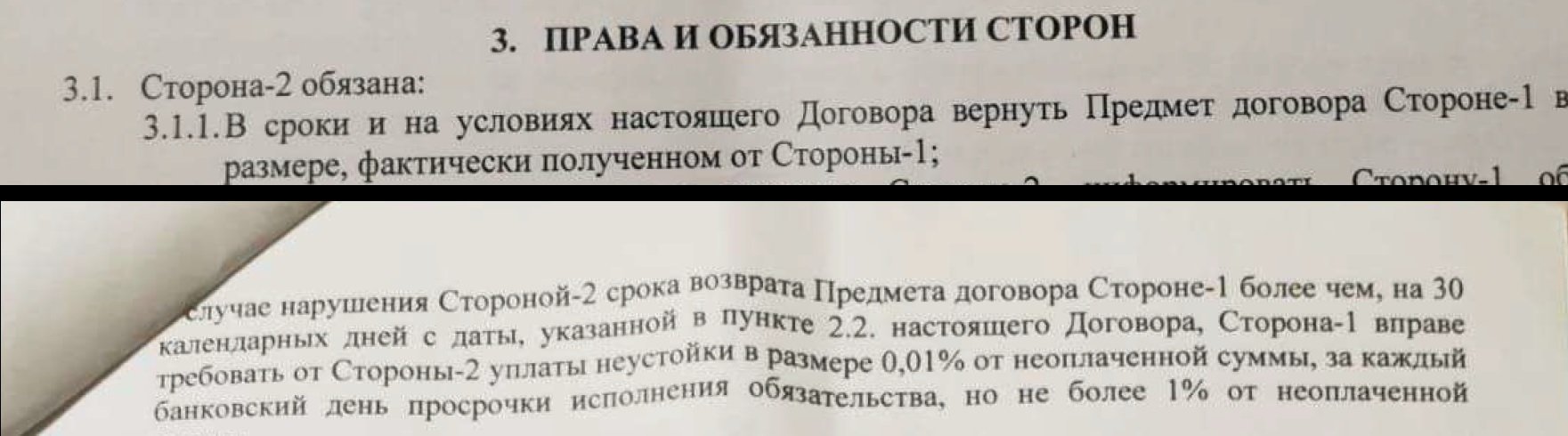

The standard contracts signed with “Tender Exchange” investors reflected that: they contained no mention of any interest. Repayment was limited to the “actual amount received,” and the penalty for delay was capped at a mere one percent — regardless of the term.

When no written terms on interest exist, courts treat the loan as interest-free and recover only the amount actually transferred, says Nazyrova.

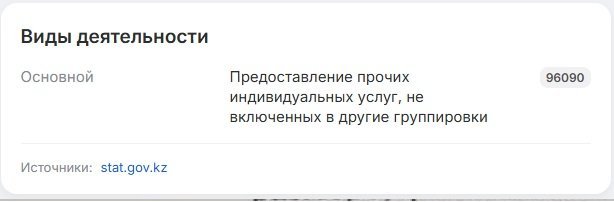

An Orda.kz journalist checked public records on the Kompra portal: “Tender Exchange” is officially registered as providing “other personal services not included elsewhere.” According to the lawyer, that’s a classic tactic for companies working outside regulation — this business classification does not cover financial operations.

Such unlicensed activity, if it causes significant losses or brings in large profits, can lead to criminal charges — up to two years in prison, and up to five years for repeat offenses.

In practice, such “loan agreements” are often found to be fictitious or fraudulent, disguising illegal fundraising schemes.

Nazyrova also notes that an audit ordered by the suspect himself would not be accepted in court. “A court recognizes only audits conducted by licensed professionals.

Anything else is just the opinion of one side — not expert evidence.

What’s Happening Now

Although “Tender Exchange” has been added to the government’s registry of unreliable suppliers, Kurmangaliyev continues to post about winning new tenders. Victims claim that similar contracts were signed through other companies, including DLVO, Alem A Group, and Sarmad Investment.

Being listed as an unreliable participant in public procurement is a serious restriction. By law, such entities are barred from tenders and state contracts for two years after being blacklisted. However, they can still engage in other legal business — as long as it’s not connected to public procurement. But if someone continues the same activities under new company names, offering similar ‘investment schemes’ and taking money from citizens, it can be treated as repeated or systematic illegal conduct, the lawyer explains.

Under Kazakhstan’s Criminal Code, such actions qualify as repeated offenses and abuse of trust, which aggravate punishment.

If a person already blacklisted as an unreliable supplier with dozens of enforcement cases continues to take money from new investors, that’s not negligence — it’s a deliberate repeat violation. The court will treat that as an aggravating circumstance, says Ilmira Nazyrova.

In early October, Kurmangaliyev also announced that he was “resuming tender training.” On his Instagram page, he invited followers to message him directly for “access to training” — allegedly to learn how to find suppliers and win tenders.

The topic of “training” has since appeared in several of his posts.

Just a day before the Champions League match between Kairat and Real Madrid, he also posted about selling tickets, writing simply: “DM me for details.”

Authorities had previously pledged to crack down on ticket scalping and limited purchases to two tickets per person using individual ID numbers.

Currently, Kurmangaliyev and “Tender Exchange” are under criminal investigation under Article 190, Part 4, Paragraph 2 — “Fraud on a large scale.” But victims say the case has not moved forward.

The case was transferred to the city police department, but its status hasn’t changed. It’s moving very slowly. We’re still hoping the authorities will finally take action, one complainant told Orda.kz.

Among the victims, he said, are pensioners, mothers of many children, and people with disabilities. Many have still not filed police reports, holding out hope that their money will be returned.

It’s worth recalling that Chingis Kurmangaliyev’s name was already linked to the Mudarabah Capital pyramid scheme. His brother, Almas Kurmangaliyev, was sentenced in 2023 to 14 years in prison for organizing the pyramid. According to defense lawyers, staff of “Tender Exchange” — including accountants and financial consultants — also appeared in that case file.

Almas has denied guilt, claiming he partially compensated investors. His company, Astex, was publicly endorsed by well-known figures — including producer Bayan Alaguzova, who said she trusted the firm because she trusted its founders, the Kurmangaliyev brothers.

After the scandal, Chingis continued to work, saying he had nothing to do with his brother’s activities.

The Mudarabah Capital case involved nine other defendants, including influencers Meirzhan Turebayev and Meirkhan Sherniyazov. Both received five-year sentences.

All of the accused denied wrongdoing and claimed they had intended to repay investors. Turebayev argued that he became a defendant because of a conflict with a high-ranking official, calling the case politically motivated. He insisted he was merely an investor — and that the real organizers were Almas and Chingis Kurmangaliyev, while everyone else “was used as cannon fodder.”

Original Author: Ruslan Loginov

Latest news

- Kadyrov Confirms Drone Damage to Grozny City

- Russia Temporarily Blocks Kazakhstan's Grain Transit, Threatening Flax Exports to Europe

- Assets of Businessman Dulat Kozhamzharov Seized Following Halyk Bank Claim

- Georgian Opposition Calls December 6 March Over Alleged Use of Chemicals at 2024 Protests

- Severe Smog Covers Oskemen

- Fire and Structural Damage Reported at Grozny City Tower Amid Drone Threat

- Pashinyan Says Foreign Influence Networks Exposed

- Kazakhstan-Based Lukoil Assets Could End Up in Hungarian Hands

- Strong Tenge Pushes Some Banks to Temporarily Stop Issuing Dollars

- Investigation Links Baimsky Project to Nazarbayev's "Wallet," Vladimir Kim

- Three Kazakhstani Nationals Arrested in Georgia Over Alleged 10,000-Ton Oil Theft

- Turkistan Region Contract for 100 Million Tenge Video Project Triggers Scrutiny

- Gennady Golovkin Becomes First Kazakhstani Honored by the International Boxing Hall of Fame

- Former Majilis Deputy Says She Was Stripped of Mandate After Criticizing Authorities

- Mangystau Authorities Investigate Death of Worker Who Fell Into Elevator Shaft

- Golovkin at World Boxing: How Kazakhstan and Saudi Arabia Are Building a New Power Structure in Boxing

- Taraz: Sentences Extended for Defendants in Group Sexual Assault Case

- Taliban Carry Out Public Qisas Execution After Teenager’s Family Killing

- CITIC Construction Responds to Activist’s Claims Over Almaty–Oskemen Highway Quality

- Kazakhstan Proposes New Law Tightening Control over Anonymous Channels