KazMunayGas Buys 60% of Oil Field from Total

The Dunga deposit's story has been continued. "KazMunayGas" intervened in the transaction of a Kazakhstani enterprise and decided to buy out 60% of the operating profit itself. Orda looked into the matter.

The Dunga deposit, like Kashagan and Karachaganak, belongs to specific projects. They are developed within the framework of a production-sharing agreement (PSA) or a production-sharing contract (PSC). International oil giants profit from cost oil and profitable oil. In the first case, they earn money via previous investments, whereas in the second, the profit is also shared with Kazakhstan.

Responding to Orda’s request, KazMunayGas could not disclose information about the value of the transaction due to the terms of confidentiality. But they have promised to share everything later in an official press release.

"We would like to note that following the completion of negotiations with TotalEnergies and receipt of relevant internal corporate and antitrust approvals, 100% of the shares of Total E&P Dunga GmbH will be transferred to KMG. The company will provide relevant information only after the completion of the transaction,"

the press service reported.

The other parties in the agreement are Oman Oil Company Ltd. and Partex Kazakhstan Corp. Both organizations own 20% of the participants' shares. The contract expires in 2039. But it may be extended.

In October 2021, the French company Total announced its intention to invest 70 billion tenge in the III phase of field development in 2021-2025. This was meant to increase oil production by 25% - up to 850 thousand tons per year. Now the question is - who will invest now and will they invest at all?

"We believe that compliance with the agreements between the parties and the state of the production sharing agreement should be maintained in order to continue the effective and rational development of the field."

This cryptic message does not give much clarity. Someone is still investing in the project and maybe even KazMunayGas itself.

The national company also could not talk about the failed deal between Oriental Sunrise Corp Ltd and TotalEnergies. The press service advised to ask questions directly to representatives of these companies.

The Dunga Deposit: from Discovery to Profit

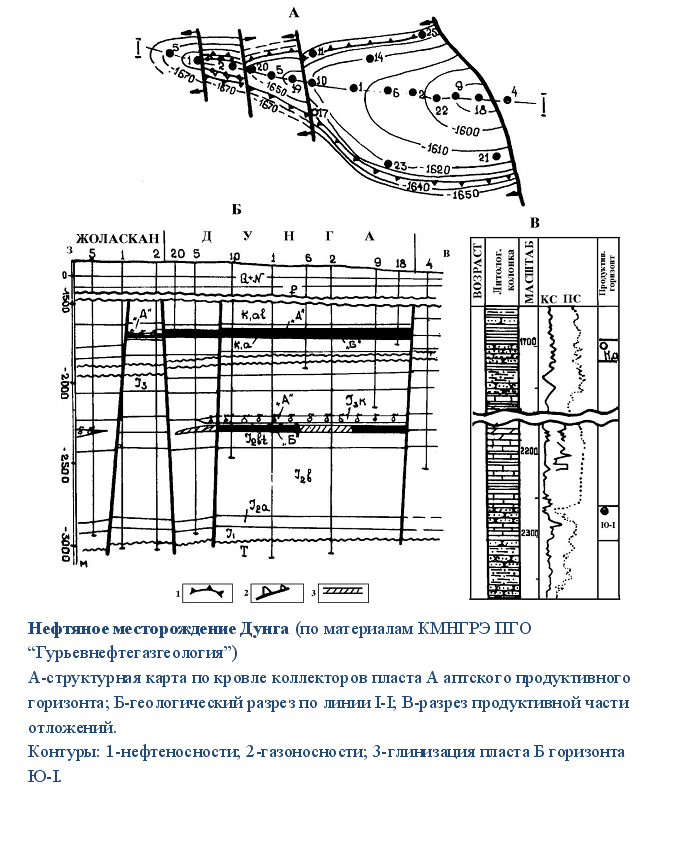

The Dunga deposit was discovered in the Tupkaragai district of the Mangistau region in 1966.

Its geological reserves amount to about 106 million tons of oil and more than 6 billion cubic meters of gas. The project has been implemented under a production-sharing contract since May 1994. Total E & P Dunga GmbH (60%), Oman Oil Company Limited (20%) and Partex Kazakhstan Corporation (20%) are the participants in the project. Total E & P Dunga GmbH simultaneously acts as the operator of the Dunga deposit.

The trial operation began in 2000. For six years, the field had been developed as part of a pilot development project. In 2007, full-scale oil production began. Since the beginning of its implementation, the state budget of Kazakhstan has received more than $300 million.

In July 2019, former Energy Minister Kanat Bozumbayev signed an additional agreement with representatives of the consortium. As a result, the contract term was increased by 15 years: from 2024 to 2039. This was necessary to increase investments by $300 million and oil production to 850 thousand tons per year.

The share of Kazakhstan's profit in this period was 40%. By January 2025, it will increase to 60%. Oil from the field must also be supplied to the domestic market. And the company should not forget about financing social and infrastructure projects.

In December 2022, it became known that the French company TotalEnergies was selling 60% of the operating stake in the Dunga site to a Kazakhstani organization. Negotiations were initially conducted by Magnetic Oil Limited LLP, but then another company was dubbed the buyer – Oriental Sunrise Corp Ltd.

In April 2023, the director of the public fund Energy Monitor, Nurlan Zhumagulov, announced KazMunayGas’s desire to buy out the majority stake in the Dunga field. The national company wants to acquire 60% via priority right.

Original Author: Maria Gorbokonenko

DISCLAIMER: This is a translated piece. The text has been modified, the text is the same. Please refer to the original article in Russian for accuracy.

Latest news

- Head of British Foreign Ministry Visits Astana

- Will Russia Outpace Kazakhstan in Chinese Gas Market?

- "Cases Are Absolutely Absurd" — Human Rights Activists on Cases against Journalists in Kazakhstan

- Orda Interviews Residents of Petropavlovsk's Flooded Suburbs

- Case Involving Journalist Adilbekov: Interior Ministry Commented on Situation

- Is Moscow Extending Reach to Kazakhstan's Oil?

- 500 Tons of Fuel Stolen from National Guard Unit: New Details Emerge

- This Is Foolish and over The Top: Forensic Expert Halimnazarov Comments On Russian Colleagues' Conclusions

- Israeli Ambassador to Kazakhstan Gives Exclusive Interview to Orda.kz, Comments on Recent Attack on His Country.

- Assault, Extortion, Police: Kazakhstani Transgender Sex Workers Reach Out

- Bishimbayev Trial: Baizhanov Could Not Be Intimidated

- "Not a Cousin, but Bishimbayev's Distant Relative": - Bakhytzhan Baizhanov's Lawyer

- Finnish Minister Arrives in Kazakhstan, Sanction Circumventing to Be Discussed

- Deputies Once Again Concerned about LGBT+ Despite Other Problems

- "I Hear The Water": Kostanay Residents in Evacuation Centers Shared Stories about Flood

- Bishimbayev's Ex-wife Reacted to His Statements Again

- Dinara Kulibayeva Ready to Give KBTU Building to State, Was Initial Sale Legal?

- Once An Island of Democracy: Kyrgyzstan Becoming Less Free

- Who Benefits from Natalia Godunova Leaving Post of SAC Head?

- Face and Profile: Photos of Kazakhs from 150 Years Ago