Behind-the-scenes: How Millionaire Yesenov was Forced to Join Jusan Bank

Orda

Orda

Orda has received documents that shed light on the sale of ATFBank

Dollar millionaire Galimzhan Yesenov is on the list of the 50 richest businessmen of Kazakhstan according to Forbes magazine. The capital of $408 million allowed him to land 19th place on the list. Among the assets of Akhmetzhan Yessimov's former son-in-law is 19.67% of First Heartland Jusan Bank JSC.

Until May 2021, Galimzhan Yesenov also owned Kazphosphate LLP in the Jambyl region. You can read about how he sold the asset here.

Merger or Takeover of ATFBank?

Galimzhan Yesenov owned the main stake in ATFBank JSC – 99.76% for quite some time. The structure of the financial institution in different years included the insurance company JSC "IC "Alliance Policy", Bank Optima Kyrgyzstan, Shymkent Brewery, collection LLP "Tobet Group", and LLP "ATFProekt", whose management acquired dubious assets of the parent bank.

As of October 1, 2020, ATFBank ranked sixth in terms of assets among Kazakhstani second-tier banks (STB). They amounted to 1.37 trillion KZT, while equity on the balance sheet was 119 billion KZT. But unexpected news on Galimzhan Yesenov and Jusan Bank's negotiations regarding the sale of ATFBank came to the fore.

On November 3, the Kazakhstan Stock Exchange (KASE) announced that the parties intended to conclude a purchase and sale agreement in November 2020. This should have happened after the approval of the Agency for Regulation and Development of Financial Markets (ARDFM) and the acquisition by Yesenov of a part of the shares of Jýsan Bank (the former name of Jusan Bank – ed.). The acquisition of shares was planned as part of an additional emission of Jusan Bank.

"After the conclusion of the purchase and sale agreement, it is also assumed that both banks will work in a unified format within the framework of a single strategy. During the transformations, all ATFBank services will continue to operate in the standard mode, which will preserve and ensure full access to existing services for its customers."

On December 30, 2012, Jusan Bank acquired 99.77% of ATFBank's shares. The total assets of the two banks amounted to about 3 trillion KZT. This is about 10% of the assets of Kazakhstan's banking sector. After the purchase, Jusan Bank capitalized ATFBank in the amount of 97 billion KZT.

"An important factor is that our clients will have access to financial services not only in Kazakhstan, but also in Russia and Kyrgyzstan through subsidiary banks of the Jusan Group,"

commented Shigeo Katsu, Chairman of the Board of Directors of Jusan Bank at that time.

As it turned out, Jusan received funds from the state on non-market terms for the purchase of ATFBank.

The Beginning of The End of ATFBank

On February 4, 2021, First Heartland Jusan Bank demanded the common shareowners of ATFBank to sell them. At the time there were only 106,269 of them. The price for one share was only 922.53 KZT. On February 9, JSC "First Heartland Jusan Bank" became the owner of 100% of the shares.

On March 16, 2021, at the general meeting of shareholders of the two banks, the merger of ATFBank JSC with First Heartland Jusan Bank JSC was approved. From that moment on, the financial institution with a "rich" history became a subsidiary bank.

On September 3, 2021, Jusan Bank received all of ATFBank JSC's assets, rights and obligations. And all trading in securities of the affiliated bank had been suspended on KASE on September 6, 2021. On November 7, 2021, the ARDFM cancelled the license to conduct banking and other operations of ATFBank (DB JSC Jusan Bank).

On December 23, 2021, ATFBank ceased to exist.

How Did Yesenov Become a Shareholder of Jusan Bank

Thanks to the documents that are at the disposal of Orda's editorial office, it became clear that not everything in the purchase and sale transaction of ATFBank went smoothly. A shareholders' agreement was signed between Galimzhan Yesenov, Jusan Technologies Ltd, JSC "First Heartland Jusan Bank" and JSC "First Heartland Securities" (FNS) on November 20, 2020. The document stipulates that any disputes, contradictions or claims should be resolved exclusively according to the Rules of the London International Arbitration Court (LCIA).

The place of arbitration is not Kazakhstan, but London, Great Britain. And the language of the proceedings is not Kazakh or Russian, but English. Arbitrators must apply the British conflict of laws rules (the rule containing the rule of determining the law applicable to regulating relations complicated by a foreign element – Ed.).

As it turned out, on January 29, 2023, Galimzhan Yesenov sent a request to the LCIA for arbitration. He wants to be compensated for the damage caused as a result of illegal actions, not limited to the loss of ATFBank shares. The defendants in the case are Jusan Technologies Ltd, First Heartland Jusan Bank and FNS.

So What Motivates Mr Yesenov's Claim?

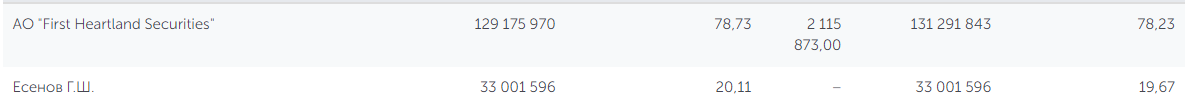

By selling ATFBank, Akhmetzhan Yessimov's former son-in-law was supposed to receive part of Jusan Bank's shares. At the moment, he owns 20.11% of common shares or 19.67% of the total share. The rest, including preferred shares, are managed by First Heartland Securities.

At the same time, the share price of Jusan Bank's assets did not cover the value of the sixth-largest bank in Kazakhstan. according to Galimzhan Yessenov, he had no other choice but to agree. This became "the last and decisive step in accordance with the raider capture plan."

According to the shareholders' agreement, Yesenov would not have received any privilege from the shares of Jusan Bank. Jusan Technologies Ltd, JSC "First Heartland Jusan Bank" and JSC "First Heartland Securities" would have also received full ownership and control over the financial institution. However, this is not the whole picture.

Galimzhan Yesenov signed a power of attorney, according to which his shares are cancelled in accordance with the non-disclosure clause

At the time of filing the lawsuit, the dollar millionaire had already received a letter from Jusan Bank with a reminder of this detail. The document was dated March 4, 2022. In April 2022, Yesenov answered that this is a false statement (About disclosure – Ed.).

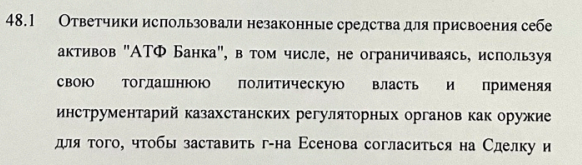

According to his version, Jusan Bank deliberately and illegally took over ATFBank. The defendants allegedly used the "political power and tools of Kazakhstan's regulatory authorities" to force him to sell the financial institution.

RMB: A court case is currently being considered in the Bostandyk District Court of Almaty. It is on the claim of the prosecutor's office against Jusan Bank. The Government of Kazakhstan wants to recognize the 1.5 billion KZT transaction between Pioneer Capital Invest LLP and Jusan Technologies Ltd as invalid. Orda.kz will continue to monitor developments.

Original Author: Maria Gorbokonenko

DISCLAIMER: This is a translated piece. The text has been modified, the content is the same. Please refer to the original piece in Russian for accuracy.

Latest news

- Timur Kulibayev vs. New Kazakhstan: Oligarch Defends His Assets

- MP supported Imam's Statements About Kazakh Traditions

- Altyn Adam: How Filmmakers Quarreled Over Cartoon About Scythian Warrior

- "No Chance": Russian Deserters' Stories in Kazakhstan

- National Fund Earns As Much As It Spends

- What is Going on with FPL Head's Recent Appointment?

- Stati Case: Victory for Kazakhstan?

- Qataris to Spend $3.5 Billion on Construction of Plants in Kashagan

- Oil Quotas: a Blessing or a Curse for Kazakhstan?

- Plant in Kazakhstan: Swiss Investor Purchased, Legal Battle Follows

- Situation with Russian Securities in Kazakhstan Explained

- Uranium Mining Tax in Kazakhstan to Change Starting in 2025

- Chinese Oil Giant to Build Wind Farm in Kazakhstan

- Expert Explains Toqayev Greeting Xi Jinping in Particular Way

- Scandal around "Aria-Zhana Astana", Controlled by Satybaldy, Not Subsiding

- SCO Summit in Astana: What to Expect?

- Who Was Oppositionist Aidos Sadykov?

- KNB Agent Orik VS Financial Police Agent Sanych

- Nazarbayev's Relatives on Trial: Systemic Purge or Political Games?

- Fire in Greece: Luxury Yacht, Kazakhstani Oligarchs' Vacation Scandal